|

Mutual Funds |

|

|

|

|

Mutual Funds |

|

|

Mutual Funds

Mutual funds are similar to stocks in that the investment and sales transactions involve shares and money amounts. But they also differ from stocks in several respects.

Decimal Precision - Fractional shares are common in mutual fund transactions. Typically, shares are tracked to three decimal places, but you can modify the Program Preferences or the Security Id record Shr Decimal field to specify greater precision if necessary. In entering transactions, there may be slight rounding differences between the Trade Price field and the prices reported on mutual fund statements. This is acceptable, provided that Captools/net share quantities and money amounts reconcile exactly with those statements.

Purchases and Redemptions - Since mutual funds have no "settlement" time, BYD and SLW transactions can be used to record fund deposits and withdrawals. These codes indicate the simultaneous deposit and purchase, and sale and withdrawal, respectively.

Reinvestments - Mutual fund dividends and capital gains distributions are typically reinvested. When this is the case for you, Captools/net reinvestment transaction codes, DRI, NQR, CGR and SGR, can be used to minimize the number of transaction entries required. Use NQR for dividends reinvested which the fund company informs you are "non-qualified".

Exchanges - Use a SLL and BUY transaction combination when moneys are moved from one fund to another fund, e.g. SLL (sell) fund "A", then BUY fund "B".

Tax Lots - Because of the way they are purchased, mutual funds are usually not subject to specific tax lot matching. For simplicity, mutual fund tax treatment should generally be first in, first out (FFO), or average (Avg) cost methods. You may specify this methodology in the Security Id records for each fund. The Avg tax lot implements the Average Cost, Single Category method allowed for U.S. taxpayers for mutual funds. Generally, this method will result in lower taxes than FFO in a rising market, but results in higher taxes in a falling market. Once you select a tax lot method for a fund, you must continue to use that method until you have closed out your position in that fund.

A third tax lot method that you may consider is the last in, first out (LFO) method. This results in an even lower tax than the Average method in a rising market. Consult with your tax advisor concerning the requirements and legality of using LFO or specific-lot methods, if you wish to use these to achieve greater tax savings.

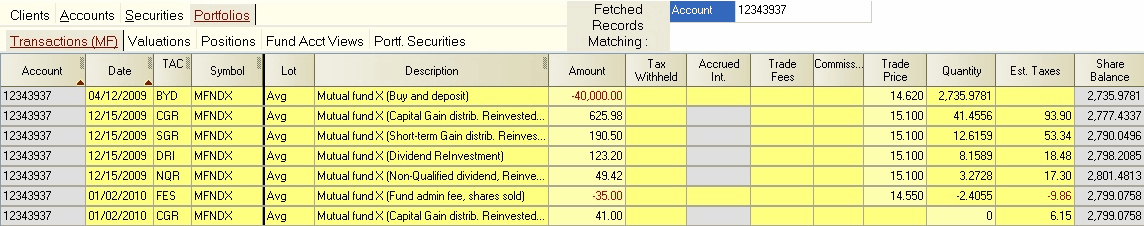

Fees - Many mutual funds levy an annual fee by reducing the number of shares to your credit. The FES (Fee-from Shares) transaction combines the FEE and SLL into a single transaction which can be used to record this charge. This is shown in the example below, which also incorporates a fund purchase and several reinvestment transactions:

Undistributed Capital Gains - When these are declared by a mutual fund company, the shareholder is required to pay tax on the undistributed gain and adjust his or her cost basis upward. This can be accomplished by using a CGR (Capital Gains Reinvestment) or SGR (short term gain) transaction with a zero share quantity as shown in the last transaction in the above example.

Mutual Fund Transactions View - In the above example, the Amount field appears before the Quantity field in left to right order. This is because most mutual fund purchase and reinvestment transactions are based upon the money amount, with the quantity computed using the trade price. This field ordering may be obtained by using the View/Switch View command and selecting the "Transactions (MF)" option. Once selected, this will appear on the transaction tab as in the example above. When entering non-mutual fund data you may again use the View/Switch View command to switch back to the standard Transaction view.