|

Mortgage Investments |

|

|

|

|

Mortgage Investments |

|

|

Mortgage Investments

Mortgage loans, as investments, are similar to GNMAs, discussed in a previous topic, except that mortgage loans are often purchased on the secondary market at a discount from the face amount. Mortgage loans also may be sold on the secondary market for a discount or a premium.

In general, you should use a BUY or BYD for the original purchase of the mortgage. Like the GNMA, payments received on the mortgage loan are broken into two components, IN+ or INW for the interest component and SLL or SLW for the receipt of principal.

If purchased at a discount, the purchase quantity and purchase amount will differ, with the quantity equal to the face value of the remaining mortgage and the amount equal to the amount paid. If sold in the secondary market at a discount or premium, the sale quantity and amount will likewise also differ.

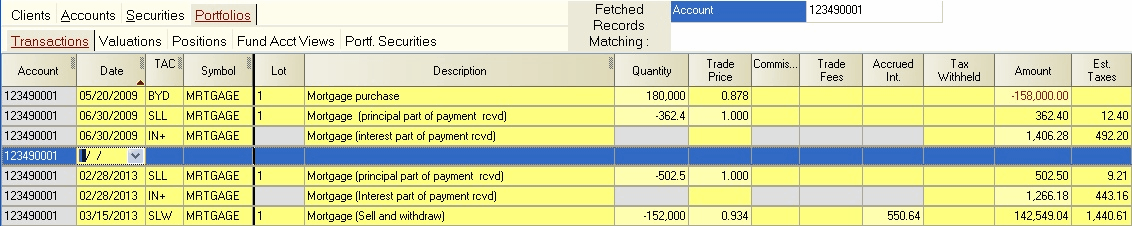

For example, suppose you purchase a $200,000 mortgage on the secondary market which originally was a 10%, thirty year loan, of which $10,000 has already been paid off. You pay $158,000 for the mortgage contract, a $22,000 discount. You hold the mortgage for about five years during which time an additional $28,000 is paid off, at which time you sell the mortgage in the secondary market for about $142,000, a $10,000 discount off the remaining face value. An additional $550 for accrued interest is also received as part of the sale. Mortgage loan transactions would appear as follows:

In this example your original cost basis of $158,000 was reduced by $28,000 to $130,000 so there will be a capital gain of about $12,000 on the final sale.