|

Options (Puts & Calls) |

|

|

|

|

Options (Puts & Calls) |

|

|

Options (Puts & Calls)

Purchases and sales of put and call options on securities can be treated in a manner similar to the purchase and sale of commodity futures options (see Commodity Futures).

Option Symbol - In order for Captools/net to successfully handle option transactions and valuations, it needs to know that the security represents an option. This is determined based upon the Security Id record Option Type setting. If this field has a value other than "None" and a Contract Date and Strike Price are specified, then the security is considered to be an option. If transactions or position records involve a security which is not found in the Security Id records and the symbol fits the pre-2010 Chicago Board of Option Exchanges (CBOE) ticker symbol convention then that security is also considered an option. The CBOE ticker symbol convention uses an identifier of up to four characters to identify the underlying security followed by a dash "-" plus two characters. The first of these characters indicates whether the option is a Put or Call and also indicates the option expiration date (A to L are January to December Calls, M to X are January to December Puts). The second character indicates the strike price, using a more complicated scheme described on the CBOE website. If you enter a new security into the Security Id records using the CBOE format, it will automatically be assumed to be an option and the indicated contract date, strike price and price factor will be set.

Prior versions of Captools software recognized a notation of appending a "+" to a symbol to indicate a Put and a "-" to indicate a Call. This notation is still recognized, but will only work for limited situations, i.e. only when a single lot of a given option is open at any one time. The CBOE symbol notation therefore preferred, and should always be used when more than one lot is open and when options with different expiration dates and/or strike prices are used. When an option symbol is entered into a BUY or BOP (Buy Option) transaction, the contract date and strike price will be pulled into the Aux Date and Aux Amount fields of the opening transaction. This allows option ticker symbols to be "recycled" from year to year, and help speeds option related computations.

After January 2010, a new industry standard option symbol convention was introduced, involving a 21 character option symbol. Since the Captools/net data tables accommodate only up to a 15 character symbol, a "compressed" version of the new option symbol is typically created by Captools during import. This compression shortens the date notation in the symbol and removes non-significant characters in the strike price part of the symbol.

Option Security Record -The Security List record contains a "Long Symbol" field which can hold the full length symbol while the regular symbol field uses the "compressed" symbol. The Security record for options must specify that the security is an option, and furthermore specify the strike price and contract expire date (whether the option is pre or post 2010).

Price Factor - Put and Call options also will typically require security list record entries containing price factors of 100, to reflect that a Put or Call typically controls a round lot, i.e., 100 shares of underlying stock.

Put Option

A "Put" is an option to sell a stock at a fixed price over a set period. It is often used to hedge against downside price risk on a stock one owns.

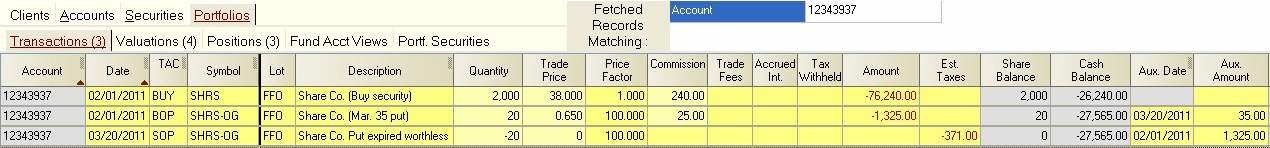

For example, you open a margin account and buy 2000 shares of SHRS on margin at 38. To hedge against a fall in price, you buy a Put on 20 contracts (2000 shares) of SHRS, expiration March with a strike price of 35, for a price of 5/8. A BOP (Buy Option) transaction is used for the purchase.

Put Expires Worthless - If the market price in this example holds above 35 until the Put expiration date, the Put expires worthless. This is indicated by a SOP (Sell option) transaction with a zero amount:

Note: This example uses a custom transaction view in which the Price Factor field is displayed to show that the option has a price factor of 100, taken from the Security Id record. You should also note that a BUY transaction may be used in lieu of BOP and a SLL in lieu of SOP.

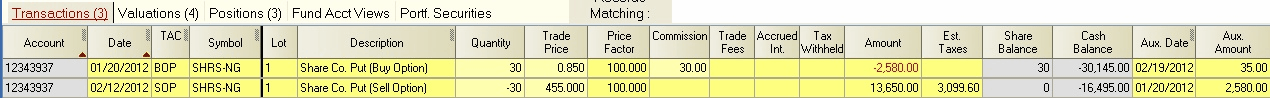

Put Sold (Long) - If an "in-the-money" Put is currently owned and is sold prior to expiration, a SLL transaction is used. The sale price will typically be close to the differential between the Put strike price and the market price of the underlying security. In this example, the underlying security falls to a price of 28 and the Put is sold prior to expiration at a price of 5.45:

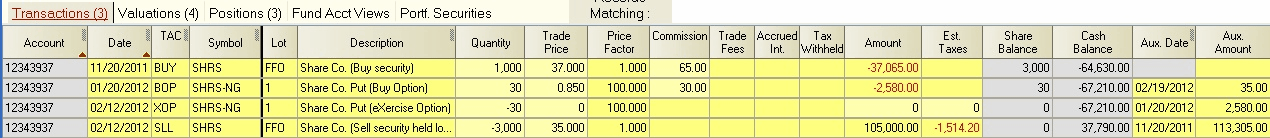

Put Exercised - If a Put is exercised prior to expiration, a XOP transaction should be used, containing entries of zero in both the Amount and Est. Tax. fields. This should be immediately followed by a SLL transaction in the underlying security. The trade price of the underlying security is the option strike price, which is "35" in this example:

The cost basis of the underlying security will be computed as the original purchase cost, plus the cost of the Put option which was exercised at the time of sale.

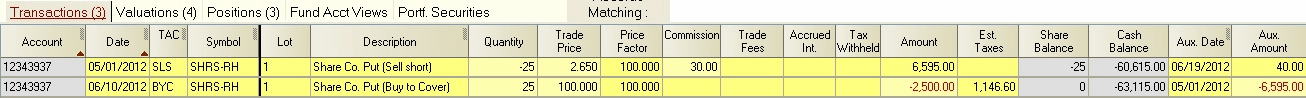

Put Sold (Short) - Puts are often sold "short" by investors speculating that the price of the underlying security will not drop and the Put will expire worthless. This type of transaction should be entered using a SLS transaction. If the Put, does in fact, expire worthless, a zero Amount BYC transaction is used.

Call Option

A "Call" is an option to buy a stock at a fixed price over a set period. Calls are often purchased upon speculation of a price rise in the underlying security. They are sold on speculation that the price of the underlying security will not rise. If the underlying security is already held by the seller it is called a "Covered Call".

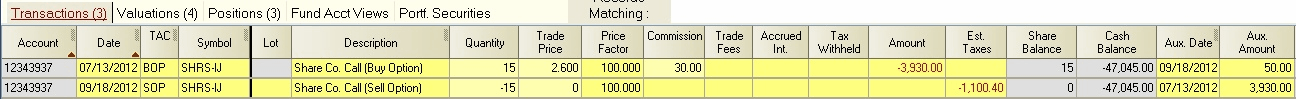

Call Expires Worthless - A SOP transaction with zero Amount should be used when a Call you have purchased expires worthless. An example of a Call purchase, followed by its expiration is as follows:

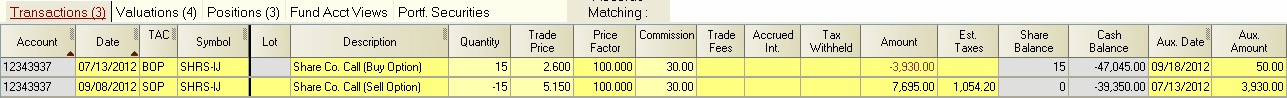

Call Sold (Long) - A SLL transaction is used if an "in-the-money" Call which you hold is sold prior to expiration. Typically, the sale price will be close to the differential between the market price of the underlying security and the Call strike price. In the following example, the underlying security rises to a price over 55.15 and the Call is sold prior to expiration at a price of 5.15 :

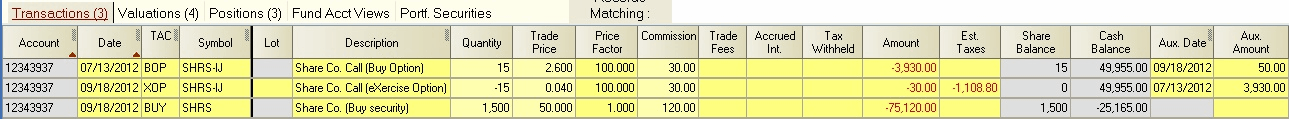

Call Exercised - If you exercise a Call option that you currently hold, enter a XOP transaction with zero Amount and Est. Tax field entries. The XOP transaction must be immediately followed by a BUY transaction of the underlying security at the Call strike price:

Captools will add the cost of the Call to the cost of the stock bought using the Call, in accordance with U.S. tax rules. This is shown in the prior example. The profit on the final sale is equal to the sales proceeds less the combined cost of the options and the security purchased at the Call option strike price.

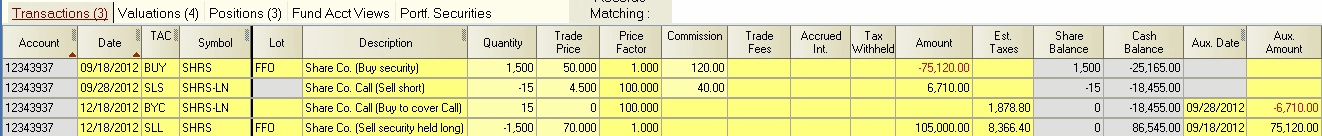

Call Sold (Short) - Selling a Call option, which you do not already own, is a short sale transaction regardless of whether or not you hold the underlying security. Such sales thus require the SLS transaction code. If the Call expires or is exercised by the buyer, a covering BYC transaction should be used with an amount of zero.

If a Call you have written reaches the strike price and the buyer of the Call exercises his right to buy at the specified price, you must then sell off the underlying security. If you already hold the security (Covered Call) this would be a SLL transaction (as in example below), otherwise it is a SLS transaction to be followed by a later covering purchase of the underlying security using a BYC transaction. The sale of and subsequent call away (exercise) of a covered Call would appear as follows:

Taxes on Options (U.S. Taxpayers) - Since the U.S. tax rules for options differ somewhat from other securities, you should check with your tax advisor to be sure you are properly reporting these transactions to the IRS. You may also need to make separate entries in the portfolio tax tables to reflect differing tax treatment for Puts and Calls as compared to other securities.

Forced Expiration - The CBOE symbol notation for options does not indicate the year of the option contract expiration. Option symbols are thus effectively "recycled" in subsequent years. Captools/net assumes that any option holding that is not explicitly closed with a closing transaction, expires after the expiration date.