|

Capital Loss Distributions |

|

|

|

|

Capital Loss Distributions |

|

|

Capital Loss Distributions

Occasionally a mutual fund will pass a Capital Loss Distribution through to you by reducing the number of shares in the fund you own and notifying you of the loss amount. Generally, this loss amount will be tax-deductible.

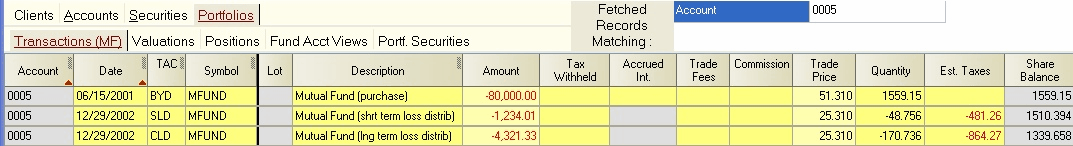

A capital loss distribution is similar to a capital gains reinvestment in reverse. However, to distinguish it from a true reversal of capital gains reinvestments, the transaction codes SLD (short term capital loss distribution) and CLD (long term capital loss distribution) should be used as shown in the following example: