|

Capital Gains Distributions |

|

|

|

|

Capital Gains Distributions |

|

|

Capital Gains Distributions

Captools/net provides for both short and long categories of capital gains distributions. Generally, your mutual fund company will identify to you whether a capital gains distribution is short or long term. If your tax laws specify multiple categories of long term gains, such is now the case with U.S. tax laws, you can specify the hold period for which a long term gain qualifies in the Hold Period field.

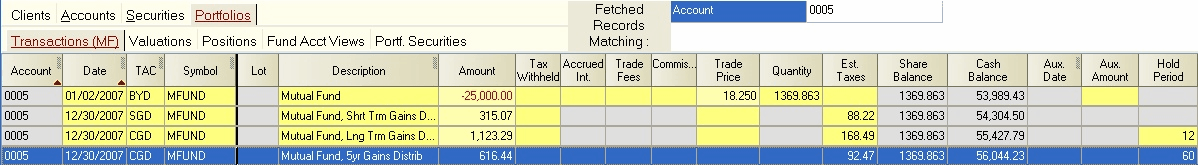

Cash Distributions - Use the SGD and CGD transaction codes for short and long term distributions, respectively, if the payments are credited to the portfolio from which they were paid, but are not reinvested in the same mutual fund from which they were paid :

Note that if there is more than one category of "long term" gains you may use the Hold Period field as shown in the above example to specify the minimum number of months holding for which the gain qualifies. Note also that this example is displayed in the transaction mutual fund format where the Quantity field is right of the Amount field. This format may be displayed by using the View/Switch View command

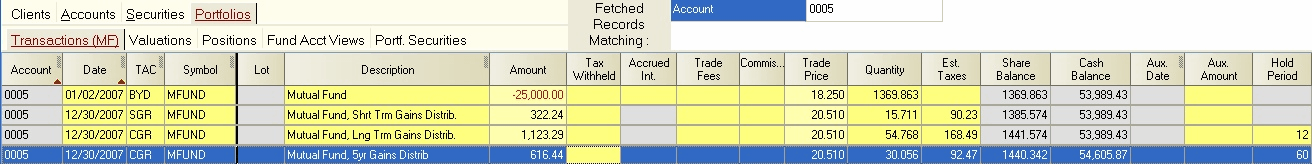

Reinvested Distributions - If the distributions are reinvested in the same security from which the distributions were paid, use the SGR (short term) and CGR (long term) transaction codes. Enter the applicable number of shares, reinvestment amount and hold period:

If you are manually entering SGR and CGR transactions, enter the quantity and amount rather than the quantity and price or the amount and price. This will minimize the chances of rounding differences between Captools and the mutual fund company or other payer of the reinvested distribution.

Reinvestment Cost Basis - Reinvested dividends and capital gains distributions are added by Captools to the taxable cost basis of your holdings. This is because you must pay taxes on the dividends and distributions when they are received. Adding the distribution amount to the cost basis prevents you from being taxed again on this amount when the shares purchased are eventually sold.

Withdrawn Distributions - You should use the SGW and CGW transaction codes if capital gains distribution payments are taken directly rather than being credited to the portfolio from which they were paid. An example of a direct payment is receiving a capital gains distribution check in the mail from your mutual fund, which you then deposit in your checking account rather than reinvest in your portfolio.

Capital gains distribution transactions are reported on the Income report in its own separate category.