|

Management Fees |

|

|

|

|

Management Fees |

|

|

Management Fees

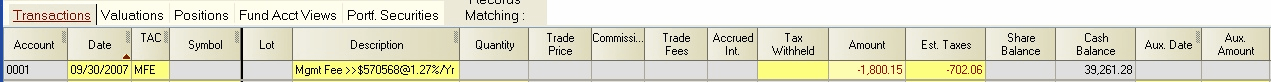

MFE - Management Fee (paid from cash): This code is used to charge a portfolio for a management fee not associated with a particular security or transaction. This code is typically used to indicate a fee charged based upon the amount of assets under management. The value in the Amount field in this transaction is classified as a "Management Fee" on Captools reports and is debited from portfolio cash.

Note: The above example shows a fee transaction automatically generated by Captools Professional and transferred from the transaction blotter. The description in this transaction shows the fee basis and fee rates for both non-incentive fees and incentive fees, which are zero in this example.

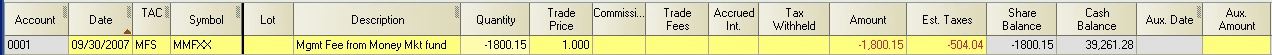

MFS - Management Fee (paid from shares sold, zero net cash change): This code is used to charge a portfolio for a management fee when the fee is paid from funds generated by the sale of shares in the security indicated in the symbol field, often a money market fund. Since this is a sales transaction, a tax lot assignment should be made if the security sold is not a money market fund (see Chapter 13, Cost Basis and Tax Lots).

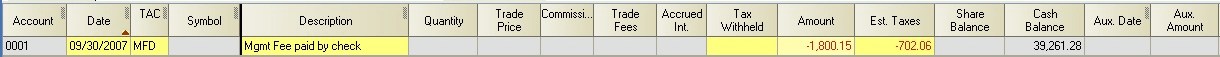

MFD - Management Fee (paid from deposited funds, zero net cash change): This code is used to indicate that the owner of a portfolio has paid for a management fee by remitting funds, typically a check, from outside the portfolio. This code has the same effect as a DPF transaction followed by a MFE transaction.

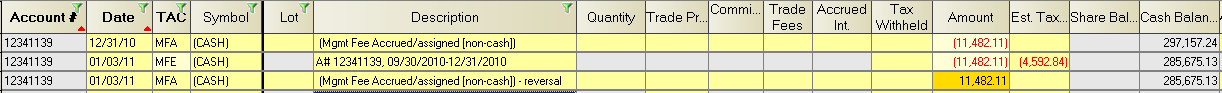

MFA - Management Fee Accrued (non-cash accrual of fee, Lev. 3/higher): This code is used to establish a management fee liability that does not affect cash. The amount sign should be negative when the liability is established and positive when it is reversed (check the "no sign calc. check box to enter a positive amount). The reversal transact is entered typically on the same date the MFE or MFS transaction is entered to withdraw the funds for the fee. The following is an example of use of the MFA transaction to effectively shift the timing of the cash debit of the fee without affecting the timing of the fee with regard to performance computations.

Advisory Fees

Some users have need for two categories of "Management Fees" because the management functions are split between two different entities. E.g. an advisor may establish the relationship with an end client, but turn over the trading and reporting to a third party firm with that expertise. Captools/net has a second category of "management fees" which we call "advisory fees" to facilitate this fee splitting. These fee codes parallel those described above for Management Fees:

AFE - Advisor FEe (paid from cash).

AFS - Advisor Fee (paid from shares sold, zero net cash change)

AFD - Advisor Fee (paid from deposited funds, zero net cash change)

If you are relying upon your custodian to implement split fees, you need to have them provide a separate fee record for "Advisory Fees" as well as for "Management Fees".

Fund Accounting Fees

PCN - Profit ConcessioN (paid from cash): This code is used when cash is removed from the account to pay a performance incentive fee from cash.

PCS - Profit Concession (paid from shares): This code is used when funds are removed (typically from a money fund) to pay a performance incentive fee.

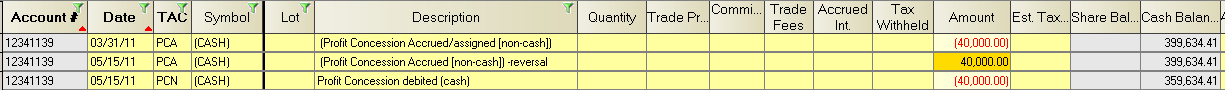

PCA - Profit Concession Accrual (non-cash): This code is used to establish a liability (negative amount) for a performance fee on the fee effective date. It is again used on the bill payment date (when PCN or PCS is used) to reverse the liability (positive amount).

The following is an example of a PCA transaction entered on the effective date the incentive fee followed by its reversal about 6 weeks later and the entry of the actual removal from the account in the amount of the fee. Note that you must check the "no sign calc. check box to enter a positive amount for the reversal transaction.

The computation, reporting and automatic insertion of management fee transactions are covered further at Management Fees/Billing.