|

Administrative and Other Fees |

|

|

|

|

Administrative and Other Fees |

|

|

Administrative and Other Fees

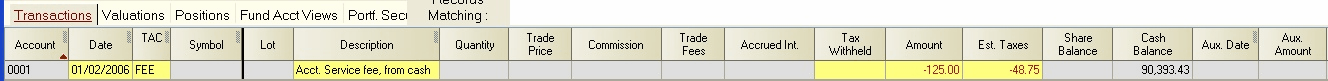

FEE - Administrative Fee (paid from cash): This code is used to indicate a debit to portfolio cash to pay for a fee related to administration of the portfolio. Typically, this code would be used to indicate payment of fees that are not based on assets under management, such as a flat service fee or time-based consulting fee.

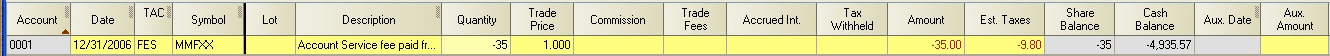

FES - Administrative Fee (paid from shares sold, zero net cash change): This code is used to charge a portfolio for an administrative fee when the fee is paid from funds generated by the sale of shares in the security indicated in the symbol field. Since this is a sales transaction, a tax lot assignment should be made if the security sold is not a money market fund. Typically, the FES code would be used to indicate payment of fees that are not based on assets under management, such as a flat service fee or time-based consulting fee.

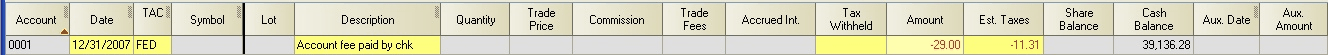

FED - Admin. Fee (paid from deposited funds): This code is used to indicate that the owner of a portfolio has paid for an administrative fee by remitting funds, typically a check, from outside the portfolio. This code has the same effect as a DPF transaction followed by a FEE transaction.

OFE - Other Fee (paid from cash): This code is used to indicate payment of a non-management related fee such as an annual custodian fee.

OFS - Other Fee (paid from shares sold, zero net cash change): This code is used to charge a portfolio for a non-management related fee when the fee is paid from funds generated by the sale of shares in the security indicated in the symbol field. Since this is a sales transaction, a tax lot assignment should be made if the security sold is a not money market fund.

OFD - Other Fee (paid from deposited funds, zero net cash change): This code is used to indicate that the owner of a portfolio has paid for a fee, such as an IRA custodian fee, by remitting funds from outside the portfolio, typically a check, to pay for the fee. This code has the same effect as a DPF transaction followed by an OFE transaction.

Mutual Fund Distribution Fees - Some mutual fund fees are levied on dividend or capital gains distributions before cash is credited or reinvested shares are computed. Because this fee is levied before the distribution is actually received, no transaction needs to be entered into Captools to reflect this fee.

For example, you hold 1000 shares of a mutual fund and they declare a $0.10/share distribution. This would ordinarily be a $100 distribution to you, except that the fund charges a $2 dividend processing fee. This leaves you with a $98 distribution. You enter the $98 into Captools as a DV+ or as a DRI transaction, whichever is appropriate to your situation.