|

Tax Withholding |

|

|

|

|

Tax Withholding |

|

|

Tax Withholding

Dividends and other distributions, particularly from foreign securities, often are received with taxes already withheld. This should be indicated by entering the amount withheld in the transaction "Tax Withheld" field.

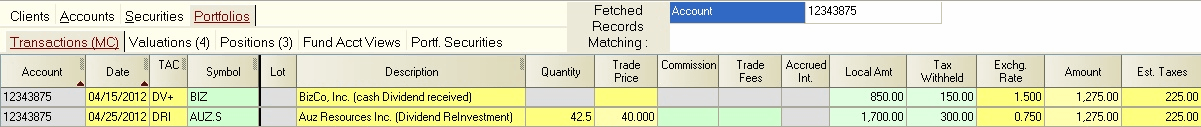

For example, consider two foreign securities, "BIZ" and "AUZ.S". Both pay a $1500 dividend before taxes (in portfolio base currency). If the "BIZ" dividend is taken in cash and the "AUZ.S" dividend is reinvested at $40/share (local currency), the transactions will appear as follows:

Note that the tax withheld in this example is entered in the local currency denomination as indicated by the field background in green. The estimated tax field is computed without regard to whether tax has been withheld, as the tax withheld is assumed to comprise all or part of the tax due. The appropriate adjustment to cash flow is made when before and after tax ROI performance is computed to allow for the fact that tax has been withheld.

ROIs & Tax Withholding - Captools adjusts before-tax ROIs upward to reflect the value of the dividends before withholding.