|

Splits and Share Distributions |

|

|

|

|

Splits and Share Distributions |

|

|

Splits and Share Distributions

From time to time a company will declare a share split or will issue a non-cash share dividend. This means that the shareholders receive additional shares for each share they currently hold. For example, in a "2 for 1" split a shareholder receives one additional share for each share currently held. A 100% share dividend also produces the same result.

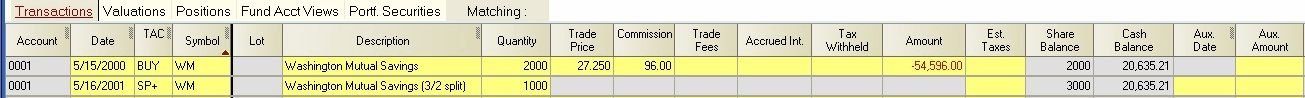

Captools/net provides split transactions to account for splits and share dividends. No lot number or amount should be entered for split transactions.

SP+ - Split Shares Received (non-cash transaction): Use whenever stock held long in the portfolio splits or issues a stock dividend . Fractional shares for mutual fund splits can be entered up to 4 decimal places.

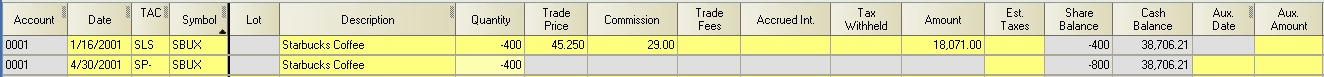

SP- - Split Shares Delivered (on short position, non-cash transaction): Use whenever stock held short in the portfolio splits or issues a stock dividend.

Split Date (Important!) - SP+ and SP- transactions should be assigned the expire date or "Ex-Date" of the split rather than the actual receipt date of the shares. This is necessary to ensure that the split transaction is dated prior to any purchase transactions which were not part of the basis for determining the split shares.

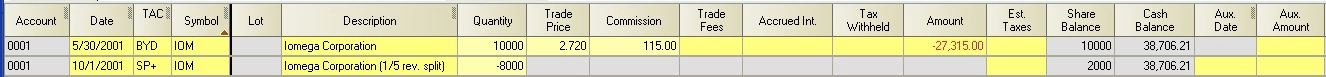

Reverse Splits - Occasionally some companies declare a reverse split . These reduce the number of shares held by each shareholder. For example, Iomega Corp. (IOM) declares a "5 for 1 reverse split", voiding old shares and issuing one new share for each five shares a shareholder previously held. You previously held 10,000 shares. Implementation would be accomplished as follows:

The SP+ transaction code is used for a reverse split, but a negative quantity is entered. In this example the "-8000" reduces the original 10,000 shares held to 2000 shares.

If a stock held short declares a reverse split, the SP- transaction code should be used, but a positive quantity is entered. In order to enter the positive quantity, first toggle the Data/Suppress Auto-Recalc function on the transaction screen. As soon as the entry is made, the auto-recalc function is automatically reactivated for other fields.

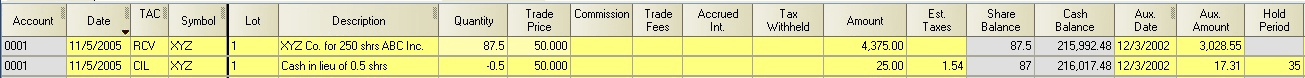

CIL - Cash in Lieu (of fractional shares, proceeds to cash): This code must be used whenever cash is received in lieu of fractional shares, which may occur as a result of share splits or share dividends or as the result of shares received in connection with a corporate divestiture or "spin-off".

Cash in Lieu is essentially a forced sale of a fractional share. It thus requires the same input as a SLL transaction. Furthermore, the associated split or receive transaction should include the fractional part of the distribution as is shown in the following example of a split transaction which resulted in cash in lieu of a half share: