|

Short Sales |

|

|

|

|

Short Sales |

|

|

Short Sales

"Short Sales" are sales of securities which are not currently held by the seller. Such sales are made possible by brokerage firms who act as intermediaries by borrowing shares from other customers' margin accounts. These shares are then delivered to the buyer. The short seller may hold the transaction open indefinitely provided that sufficient funds are maintained in the brokerage account to cover the value of the short position, and provided that the brokerage firm does not "call" in the short position. This latter case may occur if the real owner of the borrowed shares decides to sell and the brokerage firm cannot find replacement shares. Short sellers are responsible for covering all dividends paid on shares held short. A short position is closed out by buying sufficient shares to "cover" the short position.

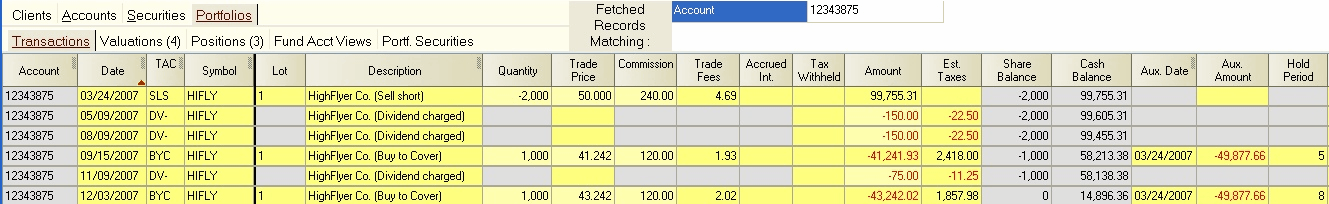

Short sales and their "covering" transactions must be entered in Captools/net by using SLS transactions for the short sale and BYC transactions for the covering buy transaction. Dividends or interest (for bonds) paid out while a short position is held must be entered using DV- and IN- transactions respectively. The following is an example of a short sale, with dividends paid, which is subsequently covered in two separate transactions:

Because it is possible to simultaneously hold both a "long" and a "short" position in the same security, Captools/net segregates these on position screens and some reports if Short Accounting is not disabled in the Portfolio Computation preferences at the program or account level.

See Sell Short / Cover for more information on handling short transactions.