|

Portfolio Computations |

|

|

|

|

Portfolio Computations |

|

|

Portfolio Computations

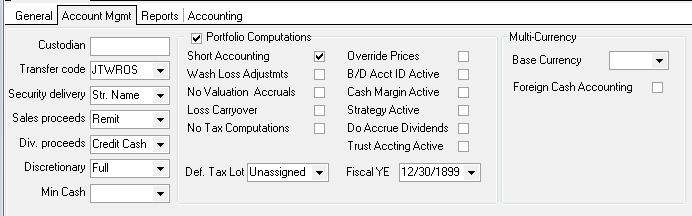

You can control the operation of some of the Captools/net portfolio computations through settings on each portfolio's accounts records, which appear as follows when the account record is placed in the Edit mode:

These controls may be individually set for each account when the Portfolio Computations check box is checked, otherwise these controls are controlled via a similar set of controls on the Program Preferences. These controls are defined such that the unchecked state is the intended default operation for Captools/net. These controls operate as follows:

Short Accounting - When selected, this specifies that short and long positions in the same security be shown separately rather than be netted to display a single combined position. (Note: Separate positions may also occur when B/D Acct ID Active and/or Cash/Margin Active are used).

Wash Loss Adjustments - This deactivates the wash-sale loss computations that are performed when a security is re-purchased shortly after it is sold for a loss. This computation is controlled by the Wash Days setting specified in the Tax Rate records for the Tax Class assigned to an account. If a wash loss situation is detected during tax computations, Captools/net inserts one or more cost basis adjustment transactions. If you take care to avoid the sale and purchase of securities that would trigger a wash loss, or if you are subject to tax laws which do not have wash loss tax rules, then deactivating this control will help speed up tax computations.

No Valuation Accruals - This control suppresses the addition of accrued interest when portfolio valuations are computed.

Loss Carryover - This causes the generation of loss carryover transactions at the fiscal year end when the estimated taxes are computed.

No Tax Calcs - This suppresses the computation of estimated taxes during various program operations. Suppressing tax computations may speed up certain operations. Tax computations may be reactivated at a later time, say at quarter or year-end.

Override Prices - Once a portfolio position record is priced it will not be overridden during re-computation of that position by a price from another data source unless this control is checked or the position price data source identifier is blank. The price data source field appears in the position records and the price history records. If the price data source value in the price history file matches that in the position record, then the position record price will be updated regardless of the setting of this control.

B/D Acct. Id Active - Certain higher levels of the Pro and Enterprise version display a broker/dealer identifier field ("Acct ID" in header) on the portfolio transaction and position records. This field allows you to differentiate transactions within a single portfolio by custodian. When this switch is active, Captools/net will compute separate positions for a given security if they contain different identifiers in the opening transaction "Acct ID" field. If this switch is inactive, then a single position will be computed for a symbol.

Cash Margin Active - This specifies that the Cash/Margin field in the portfolio be used in computing portfolio positions. If active, holdings are segregated by whether they are "Cash" or "Margin". This feature is only available in the Pro-4 or certain Enterprise versions where this has been made a licensing option.

Strategy Active - Certain higher levels of the Pro and Enterprise version display a Strategy field in the portfolio transaction and position records. This allows you to group investments within a given portfolio based upon the investment strategy employed. For example, a strategy of buying or selling options in conjunction with the underlying security could be given a common strategy identifier. When this switch is active, same-symbol transactions with different strategies will be computed as separate portfolio positions, which is necessary to facilitate reporting by strategy.

Do Accrue Dividends - When selected, this option causes accrued dividends, which occur between the dividend ex-date and actual receipt into the portfolio, to be computed and included in the portfolio value. This is typically only needed by corporations and institutions with a legal reporting requirement to include such pending receipts. This function is dependent upon the correct dividend ex-date and payment date being recording in the Security Id records for all securities held. This feature is only available in the Pro-4 or certain Enterprise versions where this has been made a licensing option.

Trust Accounting Active - This option (active at Level 4 only) specifies that an account is to use "Trust Accounting" wherein principal and income components are to be accounted separately. This is accomplished by using the "Acct Id" field in the transaction records to specify "PRN" to indicate that the transaction is applies to principal or "INC" if it is to apply to income. Cash movements are applied to principal or income based upon the Acct Id specified in the source transaction. To move an asset or cash between categories, an "SAX" transaction is used with a minus quantity and/or amount indicating movement out of the specified Acct Id category and a positive quantity and/or amount indicating movement into the specified Acct Id category.

Def. Tax Lot - This is the tax lot methodology which will be assigned to a security transaction in the account portfolio if no tax lot assignment method is specified in the Security Id record associated with the transaction. See Tax Lots and Cost Bases for more detail.

Fiscal YE - This is the fiscal year end to be used for the account, with only the month and day being significant for computation purposes. Loss carryover and other year-end tax related actions will be keyed off of this date.

Tax Deferred - When this control (appearing on the "Accounts/Account Detail/General" tab) is checked, the account is treated as a non-taxed retirement account, except for certain transactions, such as withdrawals, which would be subject to tax.