|

Interest |

|

|

|

|

Interest |

|

|

Interest

Interest payments are payments received by the portfolio in connection with bond or fixed-income securities held by the portfolio. These payments may be from corporate or municipal bonds, federal treasury securities, certificates of deposit, savings accounts, brokerage cash balances, mortgages held, or other loans, etc.

Interest payments may also be paid out by the portfolio on bond-type securities sold short, on a negative cash balance resulting from margin account borrowing, or upon the purchase of a bond carrying accrued interest.

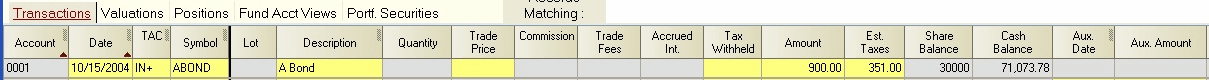

IN+ - Interest Income (to cash): Use whenever interest is paid by a security and credited to and retained in a portfolio account.

If a security has payment dates and rates specified in the Security Id records, and the transaction date matches the security payment date, this field can be computed by executing the "Data/Compute Fields" command or clicking on the "Compute" icon when the field is selected.

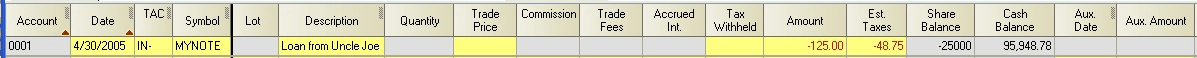

IN- - Interest Payment (from cash): - Use for debiting a portfolio for interest paid out on a security, such as interest paid on a bond held short, or interest paid on a promissory note initiated with a BRW (borrow) transaction:

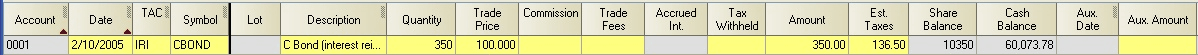

IRI - Interest Income Reinvested (zero net cash change): Use for interest reinvestment. This transaction is the equivalent of an IN+ transaction followed by a BUY using the same amount. It requires both quantity and amount inputs.

If you are manually entering IRI transactions and the reinvestment price is other than "1.0", enter the quantity and amount rather than quantity and price or amount and price. This will minimize the chances of rounding differences between Captools/net and the payer of the reinvested interest. Although typically not necessary, the "Aux. Amount" field can be used to specify a cost basis for the transaction other than the value in the "Amount" field.

Eventually, each IRI transaction must be closed with a sell type transaction. At that time, tax lot assignments can be made to match the sale transaction with purchase transactions, including dividend reinvestment purchases. See Tax Lots and Cost Bases, for examples of the use of lot numbers with IRI type transactions.

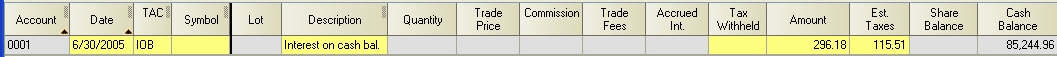

IOB - Interest Income on Cash Balance (to cash): Use for interest received or paid on the portfolio cash balance. Do not use a symbol entry. The amount can be entered as a positive or negative value depending upon whether interest is received (positive) or paid (negative).

In higher level Pro and Enterprise versions supporting "Credit/Debit" interest, the IOB transaction amount can be computed by selecting the field and executing the Data/Compute Fields command or by clicking on the "Compute" icon.

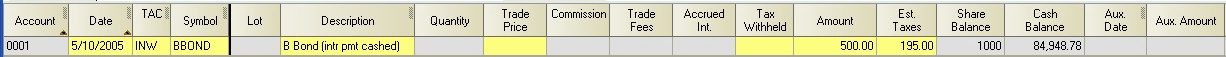

INW - Interest Income Withdrawn (zero net cash change): Interest earned, but withdrawn rather than retained in the portfolio. An example would be an interest check received on a safe deposit box bond which is cashed rather than reinvested in the portfolio.

ACL - Accrual of Interest: Use this transaction in the case where interest is accruing but has not been paid. Upon payment of the interest, an IN+ transaction would be entered and the ACL transaction would be reverse by entering an ACL with a negative amount.