|

GNMAs, CMO's, etc. |

|

|

|

|

GNMAs, CMO's, etc. |

|

|

GNMAs, CMO's, etc.

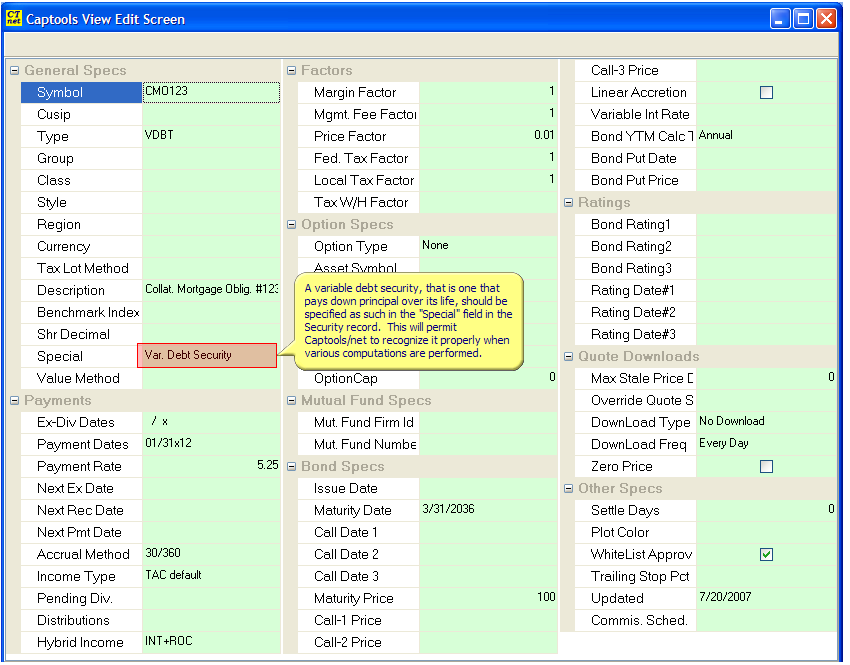

A defining characteristic of GNMA's, CMO's and some other debt investment securities is that the investment returns a payment that combines both interest and return of principal (return of capital. For Captools/net to properly compute principal and valuations of such securities, you must specify its status in the security records as follows:

Principal Computation

Captools/net computes the nominal principal of these types of securities as the unit quantity held times the maturity price times the price factor indicated in the security record. As payments are received by the holder, the "remaining" principal is computed as the nominal principal, less the sum of principal payments received. The ratio of the remaining principal to the nominal principal is used in computing the security's valuation from quoted pricing as indicated in the example below.

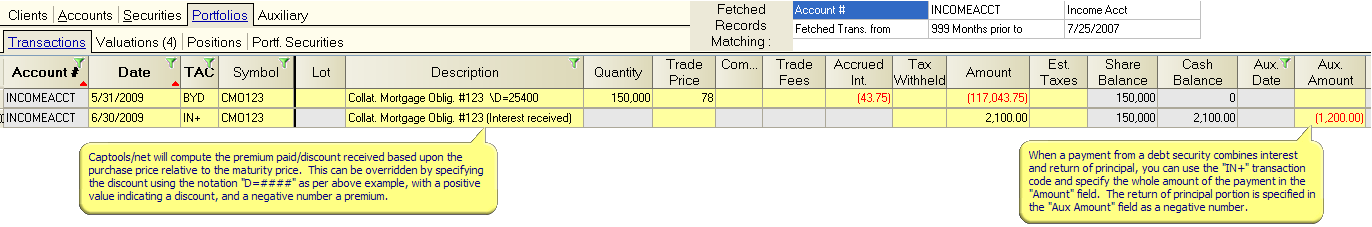

There are basically two ways that principal payments can be handled in Captools/net, with your choice depending upon your preference and how data is provided to you.

Constant Unit Method

This preferred approach assumes that the units held of the security remain constant when payments containing return of principal are received. The principal payments can entered as an explicit "ROC" (Return of Capital) transaction, or they can be entered combined with the interest payment received in a single transaction by using an IN+ transaction and specifying the return of principal in the Aux. Amount field as a negative value:

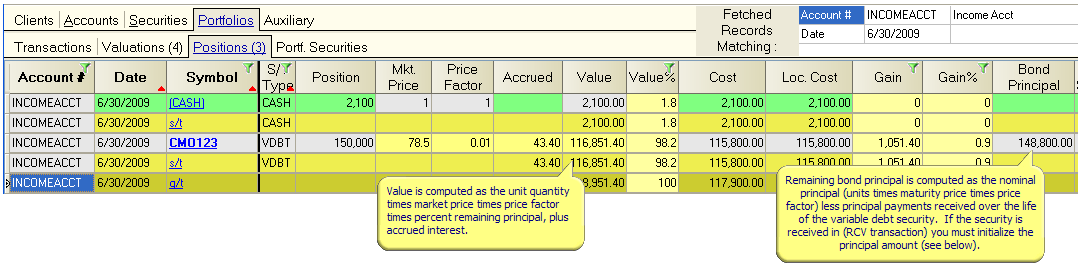

In either case, since the number of units held constant, the valuation of the security must take into account the decrease in principal. This is normally handled by Captools/net by including the percent remaining principal in the computation of the debt security's value:

If you are provided with a quoted total value for the debt security, such as in an account statement, you can alternatively simply enter the actual value of the holdings in the "Value" field on the portfolio "Positions" table.

Decreasing Units Method

Return of principal received on variable debt securities can be treated as separate SLL transactions to distinguish these payments from accompanying interest payments. Use of first-in, first-out tax lot accounting is recommended.

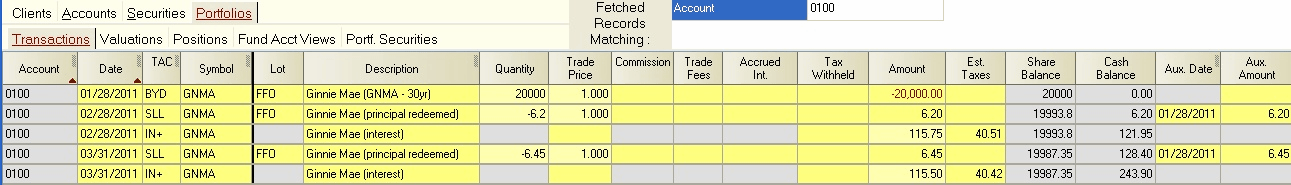

For example, you have purchased $20,000 of a GNMA consisting of 30 year loans averaging 7%. It is held in a brokerage account with the proceeds of interest and principal payments credited to cash. Your transaction entries would appear as follows (figures approximate):

Upon receipt of the last payment, the quantity held should go to zero. Since units are declining with receipt of payments, there is not a need for a principal based factor for the value computation when this approach it used.

The BYD transaction in this example should be substituted with a BUY transaction, if purchase funds come from portfolio cash. Likewise, the SLL transaction should be substituted with a SLW transaction, and the IN+ transaction substituted with an INW transaction, if proceeds from these payments are removed from the portfolio and thus are debited from portfolio cash.

Receiving GNMA/CMO Type Securities

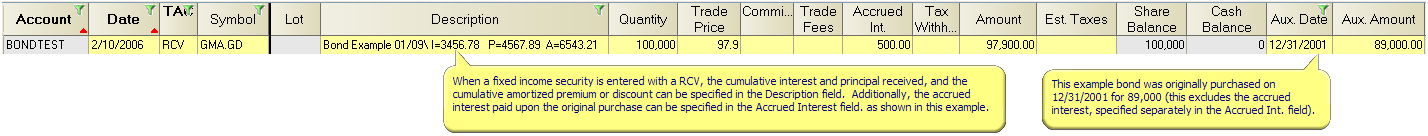

When you need to initialize a portfolio by receiving in a GNMA/CMO type security, it is desireable to specify the accumulated interest, principal received and premium/discount amortization as of the receipt date. This can be done in the RCV transaction using the following notations: