|

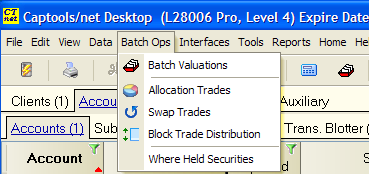

Batch Ops |

|

|

|

|

Batch Ops |

|

|

Batch Ops

Account Ops are commands which trigger data computation or management operations which are designed to typically be performed on portfolio data for more than one account. These operations may require some time (minutes) to occur due to the amount of data involved. Upon completion, the result of these will be presented on the CT/net screen, typically in a window containing temporary records.

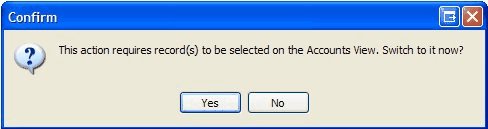

The Account Ops are accessed via the "Ops" command on the CT/net menu. You must be on the "Accounts/Accounts" view prior to executing this command. If you are on another table view, you will be prompted to change views with the following message:

Once you are on the accounts view, if you select more than one account, prior to executing the Tools command as in the following example, these will be the accounts processed in the subsequent operation, unless you specify filters in setting up the particular batch operation. If only a single account is selected, all accounts will be processed unless filters are subsequently specified.

The Ops functions operate as follows (some functions not available in lower level program versions):

This function causes valuation and position records to be created or updated in the underlying portfolios for the dates specified. It also displays the combined valuation (and combined positions using "show" function) of the selected accounts, which is often useful when managing a group of accounts.

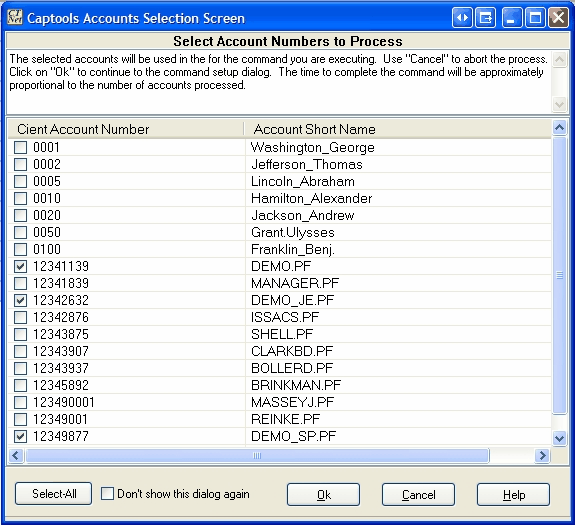

Account Selection - Upon executing the Batch Valuation command you will be prompted to select accounts to be included in the batch valuation, with the initial setting matching the records selected in the account view, unless only one record is selected, in which case all records will be assumed:

Important! - If you plan to create a new valuation date, you should select all accounts, because various Captools/net computation and reporting functions expect that account portfolios will have synchronized valuation dates. If you plan to only view or recompute batch valuations, it is okay to select a sub-set of the available accounts.

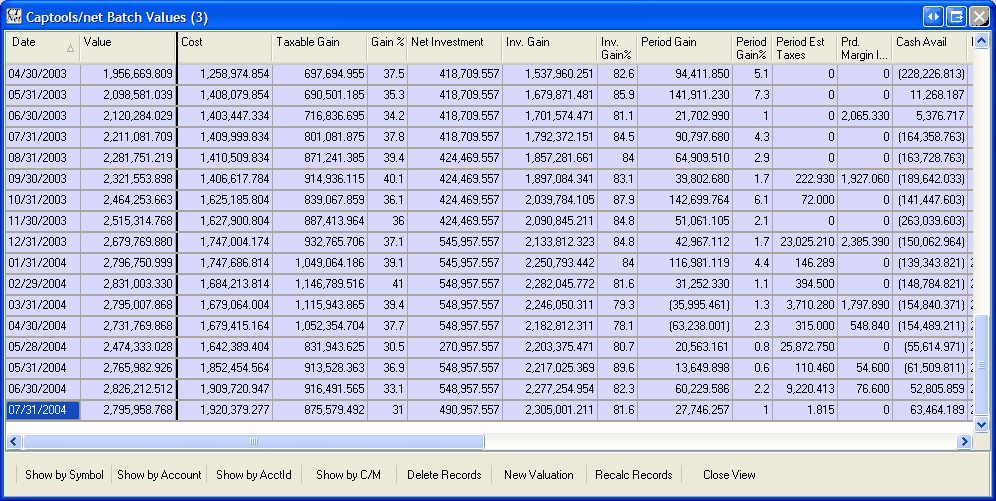

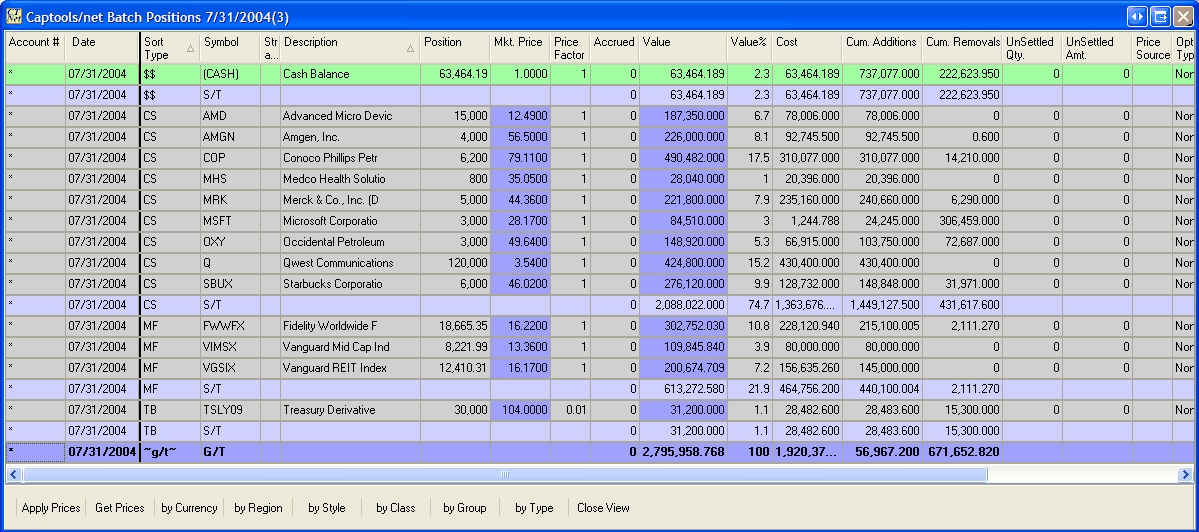

Upon clicking "Ok", the batch valuation records will be computed and presented to you similar to the following:

You can use the commands on the toolbar at the bottom of the view to see more detail, or create new valuations or delete unwanted valuations:

Show by .. - This shows the underlying position records, sorted and sub totalled according to the "Show by" button selected. The "Show by Symbol" combines all positions with the same symbol into one position record as follows:

Delete Records - This deletes the valuation records and position records for the selected date in all the underlying portfolios.

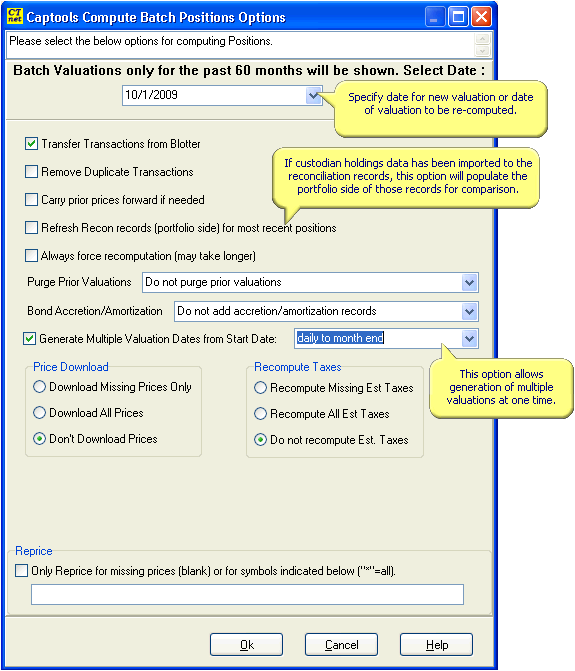

New Valuation - This command allows you to create a new valuation record in all the underlying account portfolios. You are first prompted for the desired valuation date, and other computation parameters:

ReCalc Records - This command operates similarly to the New Valuation command, only it operates upon the records that you select prior to executing the command.

Scheduled Valuations - The batch valuation function supplements scheduled valuations, available on some higher level versions of Captools/net. Scheduled valuations are triggered by the CTTasker program, following price downloads, at a frequency specified by your system's Data Administrator. If scheduled valuations are being performed on your system, you should generally use the batch valuation function to simply view existing valuations for groups of accounts, rather than use the function to create new valuations. See Scheduled Events for more details on scheduled valuations.

Closed Accounts and "No Batch" Accounts - Accounts which whose "Close Date" precedes the date of the batch valuation will be skipped during the batch valuation process. Accounts who have the "No Batch" check box checked will never be included in a batch valuation regardless of the date of the valuation.

Transfer from Blotter

This command causes the transactions contained in the transaction blotter records to be transferred to the underlying portfolios. This is useful to clear the blotter after completing your review of the data, and before importing new information into the blotter. See Transaction Blotter for more details on that topic.

Allocation Trades

This function, limited to certain Pro/Enterprise versions, allows you to generate trades to rebalance your client accounts based upon the model portfolios you have set up in the Account/Auxiliary/Allocation records. See Portfolio Rebalancing in the Advanced Appendix for more details.

Swap Trade Generation

This function, limited to certain Pro/Enterprise versions, allows you to generate "swap" trades in your client accounts. Swap trades are typically used to move assets from one mutual fund to another one, or to move money from cash to a mutual fund or other security or from a mutual fund to cash. See Portfolio Rebalancing in the Advanced Appendix for more details on Swap Trade Generation.

Block Trade Generation

Block Trade generation is a feature supported only on some higher level Pro/Enterprise versions of the software. This function permits you to allocate large block trades made in a master account to client accounts. See Block Trades in the Advanced Appendix for more details.

Where Securities Held

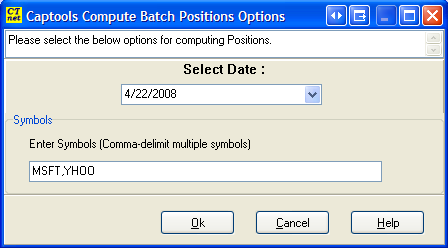

This function allows you to quickly determine in which accounts a security is held. After specifying the accounts to scan, specify the date and security or securities to show. The date should be a date on which you've created a batch valuation:

If more than one security, separate the symbols with a comma as in the above example. The resulting view will show you in which accounts the specified securities are held.