|

Variable Payment Rate Securities |

|

|

|

|

Variable Payment Rate Securities |

|

|

Variable Payment Rate Securities

Some debt securities are issued with variable payment schedules. This can be due to a desire by the issuer to delay payments and/or the payment schedule may be adjusted periodically to allow for computed inflation. These types of securities do not allow for specification of a fixed periodic payment rate in the Captools/net security record.

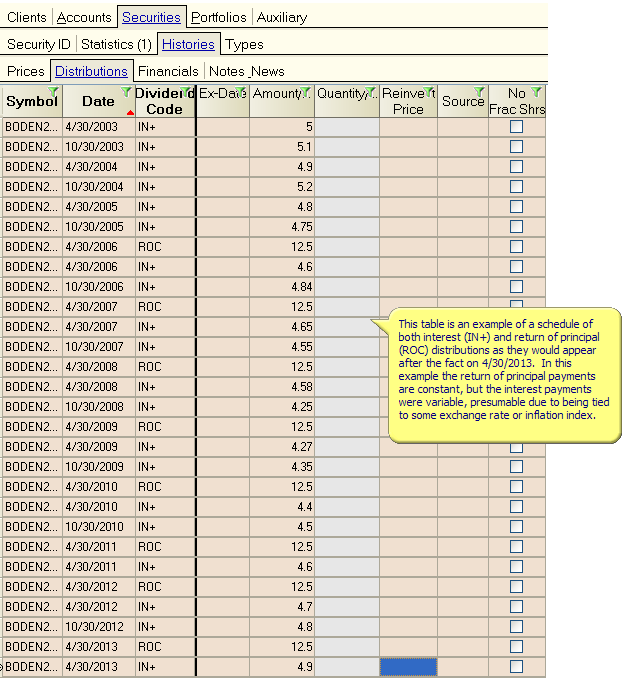

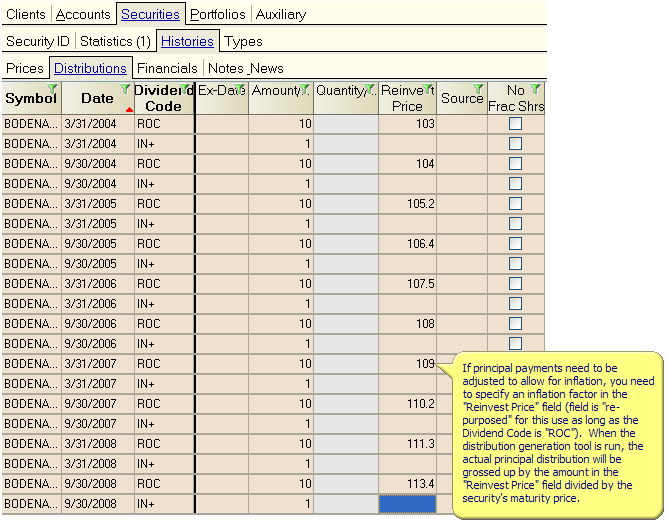

In order to accommodate these securities, Captools/net allows you to specify the payout schedule in the Captools/net Security Distribution History records:

Generating Transactions from Distribution Records

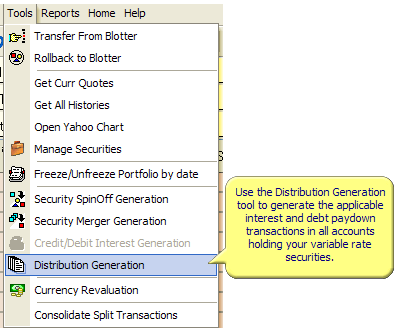

Typically a table such as the above will be updated by the user as each payment date occurs, with the appropriate amount determined according to the terms of the debt security. Once the table is updated for the current period, you would run the Captools/net "Distribution Generation" tool to generate the applicable transactions in all accounts containing the variable payment rate securities:

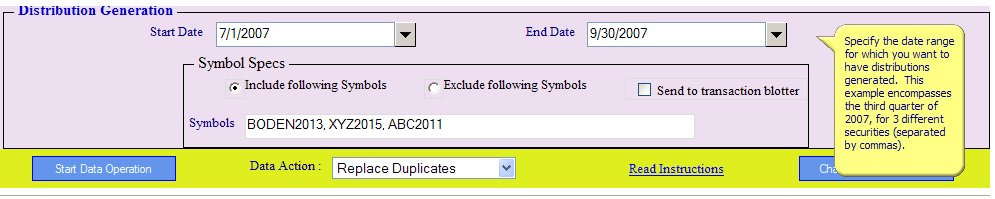

The resulting browser based tool will allow you to specify the security symbols and date range you need to have processed:

Inflation Adjusted Payments

If principal payments need to be adjusted to allow for inflation, you need to specify an inflation factor in the "Reinvest Price" field (field is "re-purposed" for this use as long as the Dividend Code is "ROC"). When the distribution generation tool is run, the actual principal distribution will be grossed up by the amount in the "Reinvest Price" field divided by the security's maturity price.

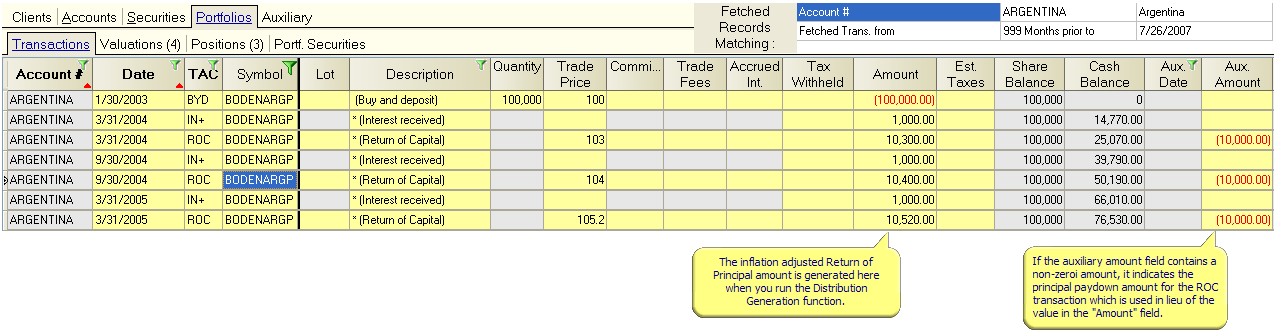

When inflation adjusted the ROC transaction is generated the ROC amount will be placed in the "Amount" field and the principal paydown in the "Aux Amount" field as a negative number: