|

Retirement Plans (e.g. 401K) |

|

|

|

|

Retirement Plans (e.g. 401K) |

|

|

Retirement Plans (e.g. 401K)

Because of their special tax treatment, tax-protected retirement accounts, such as 401K's, should generally be kept under a separate Captools/net account number from investments subject to normal taxes. These accounts should be checked to indicate the tax-deferred status and have minimum account withdrawal specified when the account owner reaches mandatory withdrawal age. See the section on Individual Retirement Arrangements (IRAs) for more details on these settings.

Employer Contribution Plans (Pooled) - Employee and matching corporate contributions to retirement plans (e.g., U.S. 401K plans) and other similar plans, often involve taking employee and/or employer contributions and investing these in a pooled portfolio managed by a plan trustee. The day-to-day transactions within this portfolio are usually not available to the participant, meaning that he or she can only track contributions and period ending values reported by the trustee.

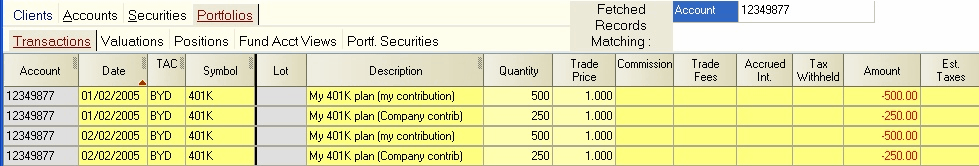

Such plans can be handled by using BYD transactions for the contributions in which both the quantity and amount are identical. For example, starting in January 2005 you contribute $500 per month, with half that amount matched by your employer:

In this example, at the end of the year, you and your employer have contributed a total of $9,000. The plan custodian reports that your holdings in the plan are now worth $10,000 on 12/31/05. You enter the 10,000 in the Value field on the Position screen resulting in the Mkt. Price field being automatically calculated.

Employer Contribution Plans (Individual) - Some employee contribution plans are set up to treat each employee as an individual plan, such that you may specify your investments and receive statements of earnings on those investments. In this case, you can enter full transactional detail of purchases, sales and income on your investments. It is recommended, however, that employee and employer contributions be entered as separate DPF or BYD transactions to facilitate later verification of correct contribution by source.