|

Options/Futures/CFDs/FRA's |

|

|

|

|

Options/Futures/CFDs/FRA's |

|

|

Options/Futures/CFDs/FRA's

Options to sell or buy securities ("Puts" or "Calls"), commodity futures contracts (Futures), contracts for differences (CFD's), forward rate agreements (FRA's) and employee stock options (ESO's) are similar in that all have a contract date and contract price. Captools/net provides a number of transaction codes that support these transactions.

BOP - Buy Option: This transaction code is similar to the BUY transaction code except that it is intended to be used only for securities such as options, futures contracts and CFD's which have contract prices and contract dates. Upon entering the transaction code and symbol for this type of security, the contract date will be retrieved from the security record into the "Aux Date" field of the transaction, and the contract price will be retrieved into the "Aux Amount" field. This will ensure that the option or future contract is henceforth properly identified even if its symbol is later "re-used" for a contract in a later year.

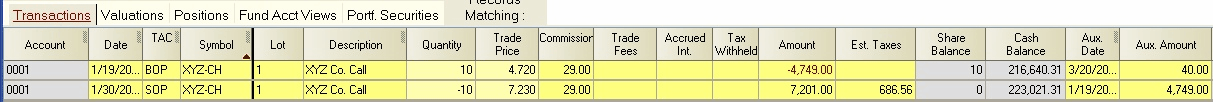

SOP - Sell Option: This transaction code is similar to the SLL transaction except that it is intended to be used only for securities such as options, futures contracts, CFD's and FRA's. It is also only intended to be used to close a transaction opened using the BOP code. The following example for a hypothetical call option shows the BOP and SOP transactions used together:

BUY and SLL transaction codes can be used in lieu of the BOP and SOP codes, provided the contract date and price are included in the BUY transaction Aux fields.

Option Symbols - Captools/net recognizes the Chicago Board of Option Exchanges (CBOE) convention for option ticker symbols and extracts the contract date and price from the symbol to populate the Security Id record at the time the symbol is added to the Security records. If you do not have a CBOE symbol, you may append a "+" to a ticker symbol to indicate an option to sell ("Put" type option) or append a "-" to indicate an option to buy ("Call" type option). Employee stock options can be indicated by appending a "^" to the symbol. (Note: CBOE symbols indicate calls with a letter in the range "A" to "L" in the second to last position and "puts" with a letter in the range "M" to "X" in that position).

Short Sale of Options/Futures - Options or Futures contracts which are sold "short", must be coded with an SLS for the opening short sale, and with a BYC for the closing covering transaction.

ROP - Receive Options (non-cash transaction): This transaction code is used to indicate the receipt of no-cost stock options into the portfolio. This could be an employee stock option or a stock "warrant" issued to an existing shareholder. Transactions entered using this code should be entered using the exercise price, and should have the option expiration date indicated in the Aux. Date field. The ticker symbol should be that of the underlying stock, but with a "^" appended. A ROP transaction should be closed out using an XOP transaction. An example of a ROP transaction with the corresponding XOP transaction is shown below.

XOP - eXercise Options (non-cash transaction): This transaction code is used to close out a ROP transaction (see above), when the option is exercised. The transaction trade price used should be the market price as of the date of the exercise transaction. The XOP transaction should be immediately followed by a BYD or BUY transaction of the underlying security at the option exercise price.

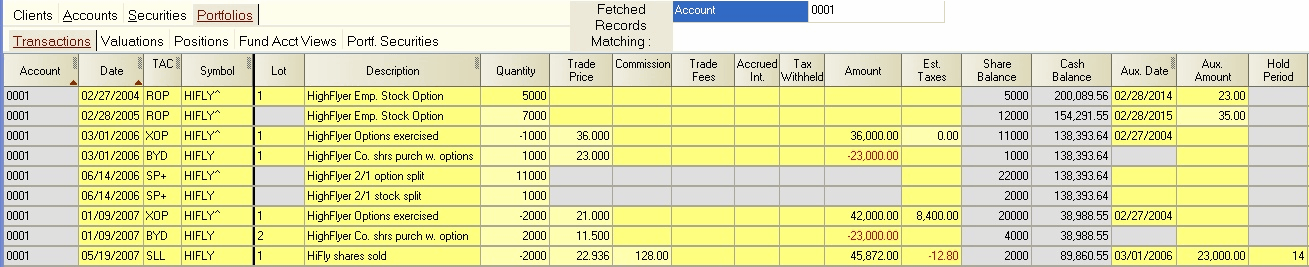

Employee Stock Option Example - A typical series of employee stock option transactions, including intervening stock splits, would appear as follows using the ROP and XOP transaction codes:

In this example, the portfolio owner received employee stock options at the end of February 2004 and 2005, covering 5000 and 7000 shares, with exercise prices of $23 and $35 respectively. He or she then exercised 1000 shares worth of options at the beginning of the year 2006, with the resulting purchased shares retained in the portfolio. The underlying stock subsequently split in the middle of year 2006. A corresponding split was entered for the options, after which more options were exercised at the beginning of the year 2007. Later that year, the shares acquired as a result of the 1/09/07 exercise were sold, resulting in taxes due on the realized gain.

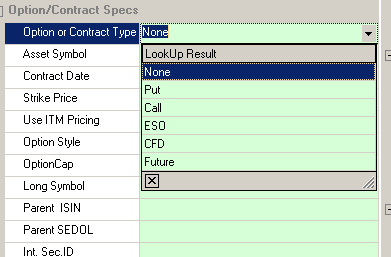

Contract for Differences (CFD's) and Futures - These are arrangements between parties, typically the investor and a brokerage firm, to credit or debit the investor's account for the difference between the market price and contract price of an underlying security or contract. In the Security Record set the field "Option or Contract Type" to "CFD" or "Future" (see below). This will ensure that the valuation will be computed based only on the difference in price between the market quoted price and the contract price.

The BUY and SLL or BOP and SOP transactions can be used on the opening and closing side of these arrangements. If no cash is to be debited (or credited) at the opening transaction, you should use a BYD (or SLW for short) code, or otherwise enter a zero amount. A contract date also will usually be specified in the security id record. In the case of where there is no definite date, this can be left empty. .

Forward Rate Agreements (FRA's) - These are similar to contracts for differences, except that the underlying "security" is a quoted rate, which could be an interest rate, e.g. LIBOR or T-Bill rate, or it could be a currency exchange rate. The opening BOP (or BUY) transaction is typically entered with a quantity equal to the money amount at stake, but a zero price (and amount) if there is no cash transaction between parties (or use BYD or SLW so no cash is debited or credited). The closing SOP (or SLL, or BYC) transaction takes place on the contract end date, and settles the difference between the parties, with the amount being positive for the investor if he/she has a gain, and negative if he/she has a loss. In the latter case, the automatic sign assignment function will need to be disabled before entering the loss in the amount field.

MTM - Mark to Market (Level 4): This transaction is provided simply to record the value change in an open commodity contract. This record type is provided to support import of MTM transactions from a custodian for information only, as the contract value is determined in the Valuation/Position records based upon the quoted price for the contract.