|

Fund Fees |

|

|

|

|

Fund Fees |

|

|

Fund Fees

Management Fees

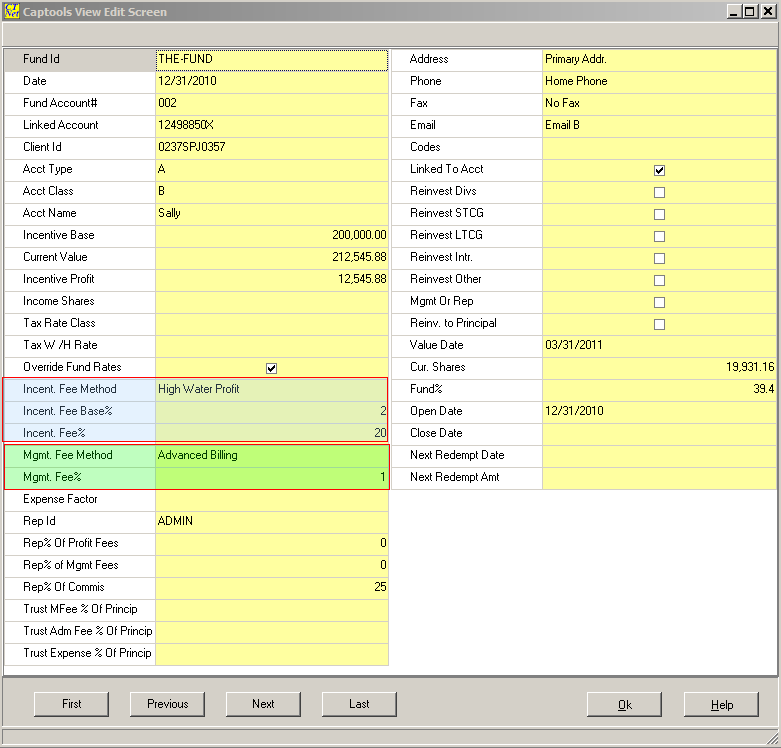

Fund management fees can be charged at whatever frequency you choose. They can also be charged at different rates for different accounts. The specification for each account is indicated in the "Management Fees" section on the fund account record dialog:

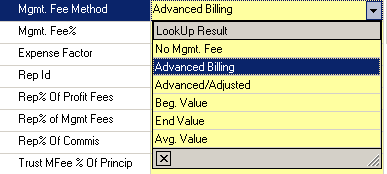

Different fee rate methods may be specified via the drop down list as follows:

These methods operate as follows:

No. Mgmt. Fee - No management fee will be charged this account.

Advanced Billing - This is used to bill the account based upon the value of the account as of the billing date. The billing computation method (discussed below) applies the specified annual fee rate to that value, for the number of days in the billing period. This period starts from the billing date and ends at a future date, specified via the "Billing Days" field in the distribution dialog (see below).

Advanced Adjusted Billing - This method works in the same fashion as the Advanced billing, except that an adjustment is made for the prior period for any account inflows or outflows during that prior period. This does not adjust for valuation changes in the prior period.

Beg. Value - This billing is computed for a period which ends as of the billing date, for the value of the account at the beginning of the billing period. No adjustments are made for valuation changes during the period.

End Value - This billing is computed for a period which ends as of the billing date, for the value of the account at the end of the billing period. No adjustments are made for valuation changes during the period.

Avg. Value - This billing is computed for a period which ends as of the billing date, for the average value of the account during the billing period. This average is computed based upon the period starting value, with time weighted average adjustments made for each date the portfolio is revalued, which is at a minimum every date on which there is a portfolio in-flow or out-flow of funds.

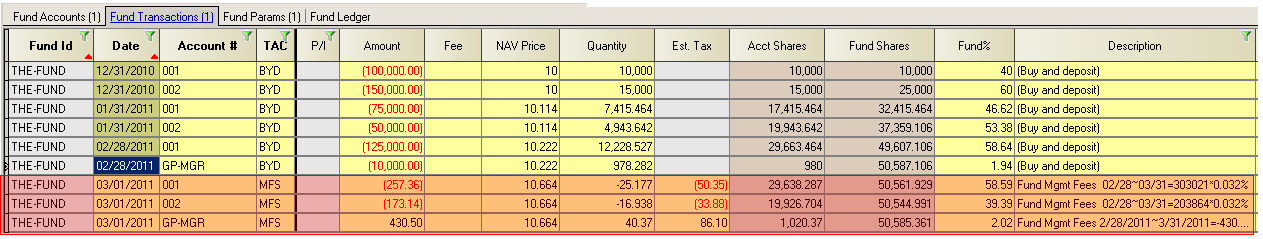

The actual fees are computed and applied by using the "Generate Transactions" command from the fund accounting transaction screen:

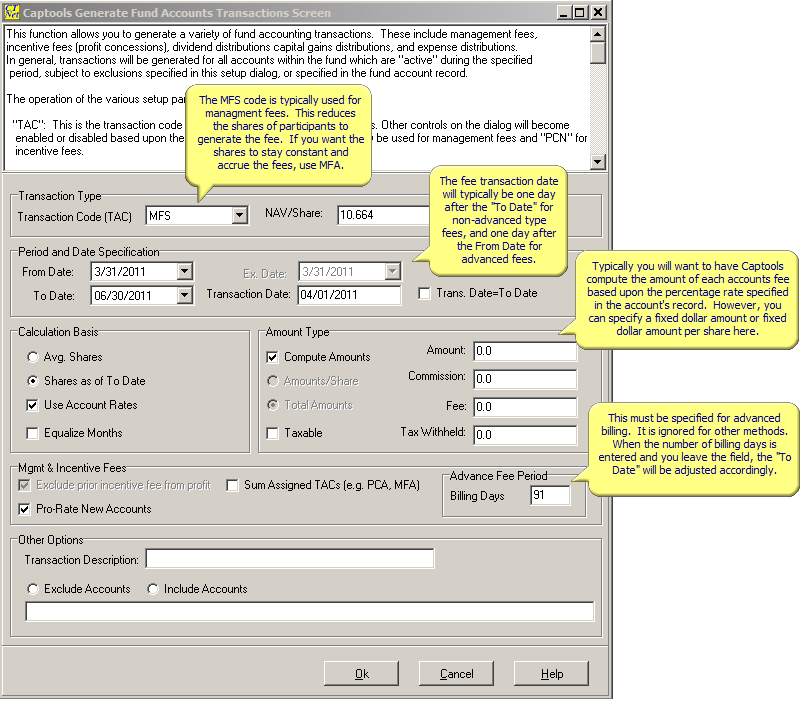

This produces the fund transaction generation setup dialog:

This dialog operates as follows:

Transaction Code - Typically MFS, MFA, or MFD is specified as the transaction code.

MFS - Shares will be reduced to pay the fee.

MFA - Does not affect shares or cash, but will be reflected in performance reports. Eventually, an expense transaction will be used to remove the funds from the portfolio (typically at quarter or year end), using the "Sum Assigned TACs" option.

MFD - This requires that the fund participants pay funds into the account for the fee. This may be the preferred method for a small private fund.

NAV/Share - This is a computed value per share figure, based upon the "From Date" for advance fees and the "To Date" for other fees. Note that a valuation is required for this date before fees can be generated.

From Date and To Date - These define the period which is being billed. The "To Date" will change if you enter "Billing Days" under "Advance Fee Period". The billing is computed from midnight of the "From Date" to midnight of the "To Date".

Transaction Date - This is the date that will be assigned to the generated fee transactions. You should typically allow Captools/net to select this date so that it is after the relevant valuation date used for the NAV/Share. (Avoid using the "Trans Date=To Date" option).

Avg Shares - If "Avg Shares" is selected the computation will be performed based upon the average value of the portfolio over the specified period.

Shares as of - If selected, the computation will be made based upon the shares held at the From date for advance billing and To date for non-advance billing. These selections are overridden by the account specifications if the "Use Account Rate" option (typical) is set.

Use Account Rates - If this is selected (typical) , the fee amounts will be computed based upon the rates specified in the fund account records. If this is not selected, you must enter the amount to be distributed in the "Amount" field of the dialog and specify in the "Amount Type" section whether the amount is the total for all accounts or is a "per share" amount.. In this case, all accounts will receive an equal pro-ratia share of the fee.

Equalize Months - This specifies treating all months as being equal time periods for purpose of the fee computation.

Advance Fee Period - This field must be non-zero if you have accounts specified to be billed on an "Advanced" basis. Enter the number of days in the period for which you are billing. You will see the "To Date" adjust accordingly to become the end date of the advanced billing period.

Upon executing the dialog, the applicable transactions will be generated in the fund accounting transaction records for each account subject to a management fee. These proceeds are credited to the accounts designated as "Managing Partners" accounts in proportion to the allocations indicated in those accounts.

Incentive Fees / Profit Allocation

Hedge Fund profit allocations, typically from the hedge fund limited partners to the general partners, are implemented in Captools/net through a "Profit Concession" (PCN) transaction. Like the management fee transactions, this type of transaction can be generated using the "Data/Generate Transaction" command.

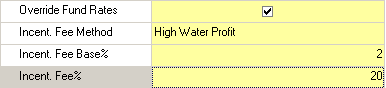

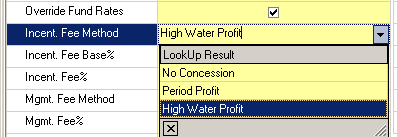

Before generating the fund concession transactions, you need to specify the concession method and percentage for each account in the fund. This is done in the fund account records, and appears as follows for a limited partner:

Note the "Incent. Fee Method" settings. These indicate the computational method which will be used for the particular account and the concession percent.

No Concession - This effectively gives a waiver to this account for an incentive fee.

Period Profit - This computes the fee based upon the profit achieved for the period specified in the dialog

High Water Profit - This computes profit in a similar fashion to "Period Profit" except that any profit achieved as a result of re-tracement of prior losses in the particular account is not included in the profit used in computing the concession.

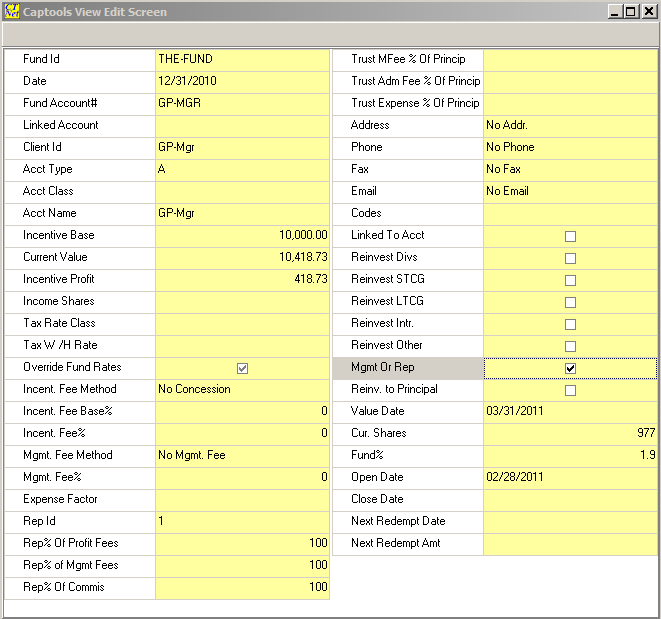

General partners typically receive the proceeds of the profit concessions. This is accomplished via "reverse sign" PCN transactions credited to the general partners' accounts. The fund account record for a general partner will appear similar to the following:

Note that the "Mgmt or Rep" block is checked in this example. This causes the account to receive the indicated percent of any management fees transactions and profit concession transactions.

In this example, the account will get 100% of all management fees and profit concessions. If there are other "Mgmt or Rep" accounts, the percentages should sum to 100% (if not, Captool will normalize the percentages).

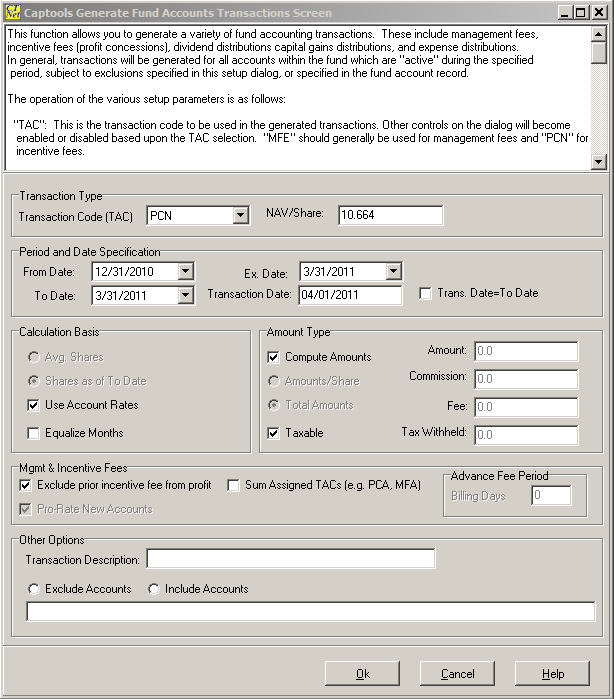

The Incentive Fee transactions are generated when the "Data/Generate Transactions" command is executed. Set the TAC code to PCS to reduce participant shares and credit management shares or to PCA to defer share re-assignment. Specify the applicable date range, and check off "Use Account Rates":

Upon executing the dialog, Captool will generate the PCN transactions, including the reverse transactions crediting the general partners. These amounts can be reported to the limited partners when you run the period ending reports. General partners may remove funds by liquidating shares received as a result of the concessions.

PCS vs. PCN TAC code - The PCS TAC code implements the profit concession by liquidating limited partner shares to pay for the concession and crediting those shares to the general partners accounts. The one drawback of this approach is that it creates a possible tax liability for the limited partners. The PCN TAC code resolves this by not liquidating limited partner shares, however it credits additional shares to the general partners accounts in sufficient quantity to equal the total concessions receive. Note that this increases the number of outstanding shares, thus lowering the NAV. If some limited partner accounts have discounted rates, e.g. 10% instead of the usual 20%, then Captools/net will credit these accounts with a return of capital (RCR) transaction in the amount of the discount. This same treatment occurs for management fees when using the MFE code in lieu of the MFS code, so you should use the MFE code for fees and PCN code for concessions if you wish to avoid creating taxable events.