|

Dividend Accruals |

|

|

|

|

Dividend Accruals |

|

|

Dividend Accruals

Some users may desire or need to adjust the value of portfolio holdings for "pending dividends", that is dividends which have not yet been delivered to the portfolio but which have passed their "ex-date". This is sometimes referred to as "Dividend Accrual". Usually this is only needed if the ex-date and payment date straddle a reporting or portfolio valuation date and the user is reporting values to GAAP standards (e.g. for a corporation) and/or the user must report performance figures to CFA Institute AIMR standards (see AIMR/GIPS Compliance).

Captools/net facilitates this in Level 3 and higher versions by computing the pending dividend and adding it to the security's valuation. Several pre-conditions in addition to software level must be met before the dividend accrual function to apply:

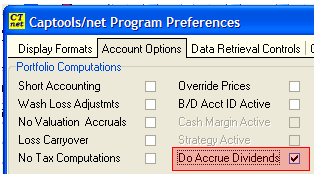

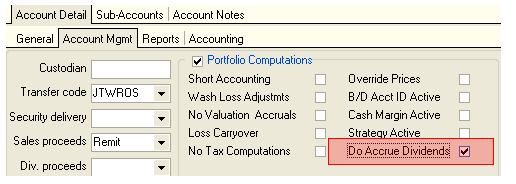

1) Activate Dividend Accruals - The dividend accrual functionality must be first activated at the program or account level:

Dividend Accrual Activated at Program Level

Dividend Accrual Activated at the Account Record Level

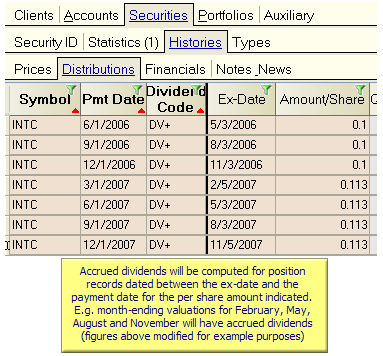

2) Specify Security Payment History - These are specified in the Security Distribution records so that the correct accrual can be computed for any valuation date.

Note: Obtaining the figures for these records can be tricky. Some data sources such as financial websites like Yahoo will provide the Ex-date, but not the payment date. Data provided by custodians may only include transactional payment dates but no ex-dates. The "investor services" area on most corporate websites can provide this information, however.

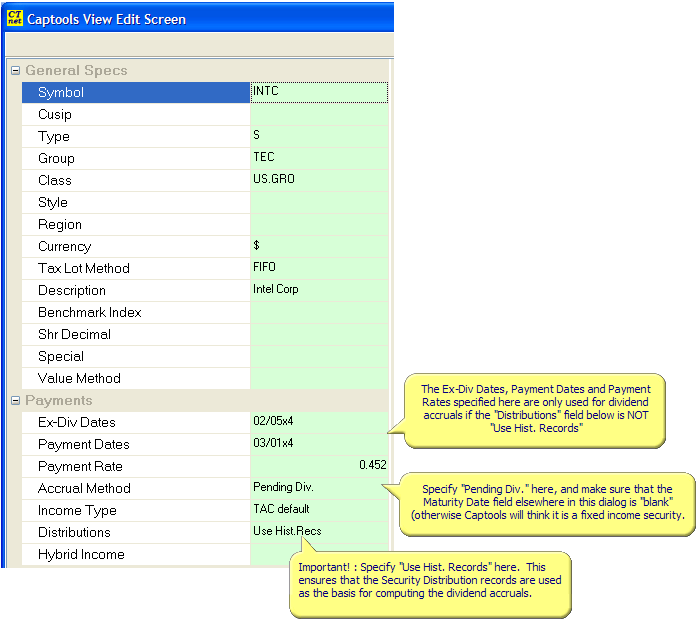

3) Specify Accrual Method and to Use Distribution Records in Security Id Records - You must specify the "Accrual Method" as "Pending Div." in order to trigger dividend accrual computations. Also, there should be no maturity date specified for the security, otherwise Captools will consider it a fix income security.

Prior versions of Captools used the Ex-Dividend, Payment Dates and Rates specified in the Security Id records. These fields are still shown for backward compatibility of data. However, it is preferred to use the Security Distribution records for dividend accruals, so set the "Distributions" field to "Use Hist. Recs." as indicated below.

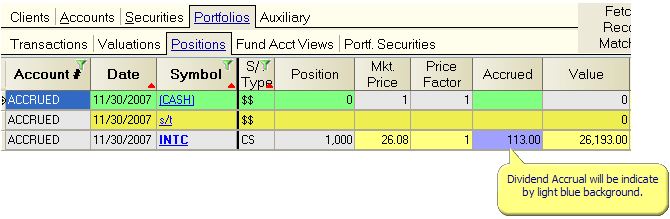

4) Compute Valuations - Upon computation of valuations, the accrued dividend will be computed and added to the valuation of the security's position. If you re-specify any of the above settings after the valuation has been computed, highlighting the "Accrued" field on the position records and executing "Data/Compute Field" function will recompute the accrued amount and add it to the valuation.

Reporting with Dividend Accruals

Dividend accruals for purposes of including them in ROI performance figures can pose another issue in reporting in that many custodians report to clients figures that do not include dividend accruals. In these cases you may want to report security valuations that do not include accrued dividends to provide consistency with your clients' custodian. This capability is supported in Captools/net's Level 4 versions via some extra reporting fields which support reporting starting and ending values which exclude dividend accruals even though they are included in the Captools/net position records and are included in the performance computations. Some of these fields are as follows:

Start Loc Value w/o Accr Div

Start Value w/o Accr Div

Start Val% w/o Accr Div

End Loc Value w/o Accr Div

End Value w/o Accr Div

End Val% w/o Accr Div

End Gn w/o AccrDiv

End Gn% w/o Div Accr