|

Benchmark Indices |

|

|

|

|

Benchmark Indices |

|

|

Benchmark Indices

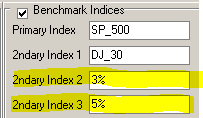

Captools/net performance reports permit you to specify Benchmark Indices for performance comparisons, with a Primary indices and up to 8 secondary indices includable in reports. The program preferences (see Program Preferences) permit you to specify the desired benchmark indices at the user-level. However, since you may wish to use different indices for different accounts, you may override these preferences at the account level (see Client/Account Edit View). The indices that you specify, depending upon your program level may be either Standard Market Indices, Synthetic Indices, and/or an account-specific Blended Index. Captools/net reporting at the higher program levels additionally can report the performance of an index based on a Model Portfolio assigned to each account.

Standard Market Indices

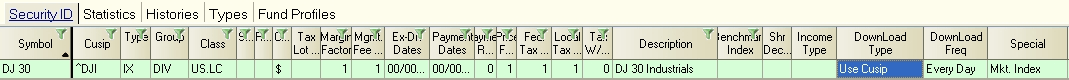

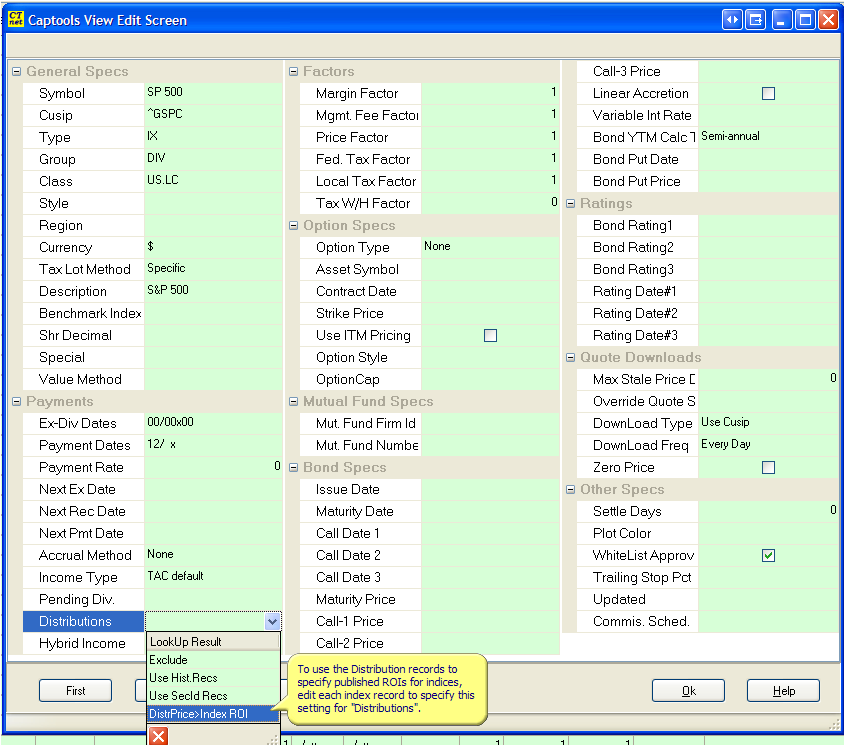

Standard Market Indices are benchmark indices whose composition and values are regularly reported in the financial media. Examples are the Standard and Poor's 500, the Dow Jones 30 Industrials, the Russell Two Thousand, the Nikkei 225, FTSE 100, etc. If you want to use such standard indices in your reporting, you must enter the appropriate ticker symbol for each such index into the Security ID records, along with the appropriate description. You should also set the Security Id record "Special" field to "Mkt. Index", so Captools/net knows that it is not a normal security:

Standard Market Index Pricing - Since various download services use different ticker symbols for market indices, you need to make sure that the symbol you use is the same as used for that index by the download service you are using, or, alternatively you need to place the quote service's ticker symbol in the Cusip field in the Security Id record and set the record's Download Type field to "Use Cusip", as shown in the above example. The sample security list data which accompany's Captools/net contains some of the more frequently used standard market indices configured to download prices with Captools/net standard download script (see Download Scripts).

Synthetic Indices

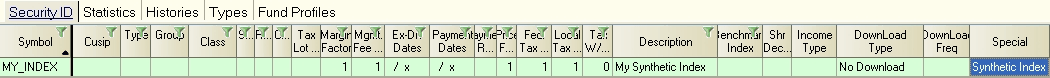

Synthetic Indices are indices which Pro/2 and higher levels of Captools/net software can compute based upon the pricing of one or more other securities contained within the security records. Captools/net uses the Security Note records to implement synthetic indices. To set up a synthetic index, first add your symbol to the Security Id records, taking care to chose a symbol that will not conflict with any traded security or standard market index. Also specify the download type as No Download and the "Special" type as Synthetic Index:

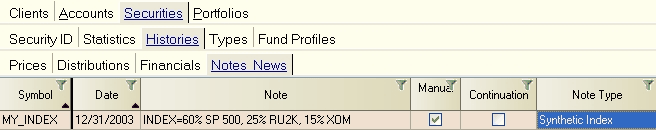

Tab to the "Histories/Notes News" tab to create a record in which you will specify your synthetic index in the note field:

Note in this example that the index is specified as a mix of two standard indices, plus a traded security. If "MY_INDEX" is specified as a benchmark index for one or more accounts, when called upon to compute performance, Captools/net will compute the performance for each one of the index components and will weight the performance according to the specified percentage weighting's, with adjustments made if the specified percentages do not add to 100%.

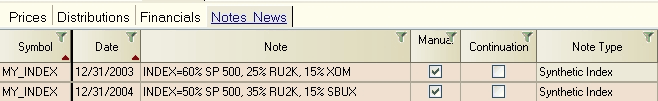

The prior example is a Static synthetic index, in that it represents a fixed mix underlying securities for the full period being reported. In higher level Pro versions you can construct a Dynamic synthetic index by entering multiple dated note records, with each one specifying a different mix of underlying standard indices and/or traded securities, e.g.:

In program versions which support the Dynamic index, the report will compute the Dynamic index performance based upon the mix of underlying indices in effect at the time. In this example, for a report from 12/31/03 to 12/31/05, the blend specified in the first record will be used to compute the synthetic index from 12/31/03 to 12/31/04, and the blend specified in the second record will be used for the remainder of the period. If you have multiple records, and your program version does not support synthetic indices computation, the last specified record will be used for the entire reporting period.

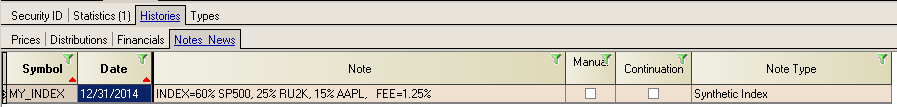

Synthetic Index with Fee Deduction - If you would like your synthetic index to reflect the application of "real world" management fees, simply append the note with the desired rate, as in the following:

where the fee rate is expressed as an annualized percent. The computation will adjust this rate to take into account the length of period being reported.

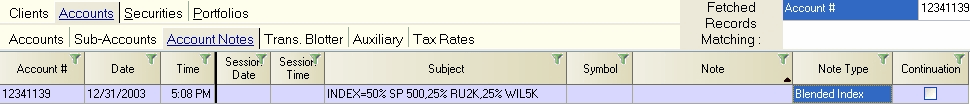

If you have a Pro/higher version and want to construct and report a unique synthetic index for each account, you can do so using the Account Note records to specify how the index is constructed:

This index will be reported when you select the Report fields prefixed with "Blended Index" on the Portfolio Performance reports.

The Model Portfolio Index is a form of synthetic index based upon the Investment Style assigned to an account. Investment Styles assigned in the account records are implemented in the Allocation Records. Allocation records specify the percentage allocation for the Investment Style at a particular point in time.

Allocation records serve three purposes. First they are used as the basis for the "Model%" figures used when a report is generated to compare actual portfolio allocation versus the model. Secondly, they can be used to generate trade records to re-balance accounts to match their assigned investment style (see Portfolio Rebalancing for more details). Lastly, they are assumed to reflect the investment policy for the accounts to which they are assigned.

To generate reports which use the model portfolio as a benchmark index, you should NOT add the investment style to the Security ID records. This is because the model portfolio assigned to each account is implicit based upon the accounts investment style. Instead, all you need to do is to specify any of the available report fields for "Model Portfolio ROI" to obtain its performance for the specified reporting period. In general you will see two types of Model Portfolio ROI, Static and Dynamic. The static version computes time-weighted ROI for the latest model portfolio defined as of the end date of the reporting period. The dynamic version computes time-weighted ROI for the model portfolio taking into account any allocation changes that were specified within the reporting period.

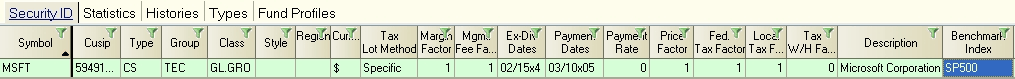

In addition to permitting you to compare account portfolio performance to the indices described above, Captools/net allows you to assign a benchmark index to each security in the security list:

You can specify here any standard market index or synthetic index that is listed in your security records, however a standard market index is preferred for faster report generation. The performance of this index can be reported on performance reports which show security detail. The asset weighted average security benchmark performance can also be reported on portfolio performance reports in higher level Pro versions. This allows you to compare portfolio performance versus the average of all the benchmarks assigned to assets in the portfolio, thereby highlighting whether your holdings were outperforming their assigned benchmarks on average.

Benchmark Index Performance Computations

Captools/net benchmark index performance computations are based upon the prices contained in the Price History records for that index, plus any "dividends" appearing in the dividend history records. It is thus essential that every index you plan to use have a complete set of price records for the time period which you will be reporting. Furthermore, if you are using synthetic indices or plan to report the performance of each account's model portfolio, then all of the securities or indices specified as part of the synthetic index or model portfolio must have complete sets of price records for the reporting period.

Dividends - While the dividend history for traded securities are usually readily obtained via downloads, this information is often not available for standard market indices. Thus, if you report the performance of such indices for comparison with your managed accounts, you should either footnote that the market index performance is based upon prices only and does not include dividends, or you should take steps to add approximate dividend information for the market indices to their dividend histories. One relatively easy approach to this is to find an index mutual fund which tracks the index you would like as your benchmark, and use that fund as your benchmark, being careful to ensure that the fund's distributions are recorded in the dividend history.

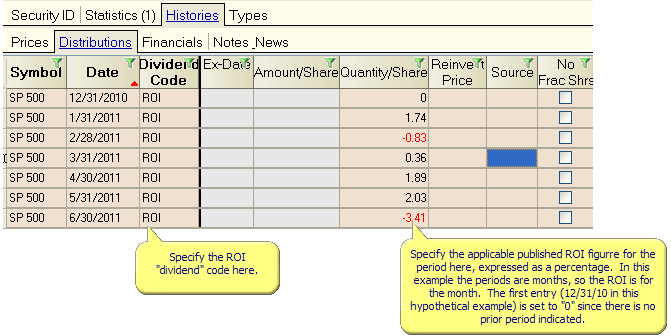

Published Market Index ROI's - If you have ROI's on indices, you can enter these for the Index Security in its "Distribution" records. This is done by first setting up the index security record to indicate that you want to have the ROI's computed from published figures you have entered into the Indices distribution records.

Next, use the distribution records for the index security to specify the published ROI's as follows:

It is necessary that the "Prices" records be left empty for such an index, otherwise the performance will be computed from those in lieu of from the distribution records above.

Fixed Rate Index - A fixed percent rate can be specified as follows. This is typically going to be used only for growth chart purposes, upon which the plot will appear as a slightly upward parabolic curve.