|

Annuities |

|

|

|

|

Annuities |

|

|

Annuities

Annuity contracts are normally purchased from insurance companies so as to obtain regular income over a specified period of time or to provide guaranteed income until the purchaser's death. The annuity purchase payment is invested by the insurance company and effectively accrues income tax free until actually paid to the annuitant (usually the purchaser). Payouts may begin almost immediately as with an immediate annuity or be deferred as with a deferred annuity.

When annuities are used within tax-qualified plans, such as group pension plans and IRAs, contributions are exempt from federal and most state income taxes, but 100% of payouts are subject to taxes. Conversely, when annuities are not part of a tax-qualified plan, they receive no tax benefits at the time of purchase. However, once annuity payout commences, only the portion of the payment which was not originally paid-in by the purchaser is usually taxed. Annuity payouts, in this case, must therefore be broken into taxable and non-taxable components when entered in Captools transaction records.

The relative proportion of payout components is governed by IRS rules and depends upon a number of factors including the amount actually contributed to the plan, the annuitant's life expectancy, etc. If these proportions are not specified in the contract, you should contact the annuity issuer for this information. The non-taxable portion of the payout should be specified as tax-free by manually entering "0" in the transaction Est. Taxes field. After the original investment is recovered, 100% of the payout is taxable.

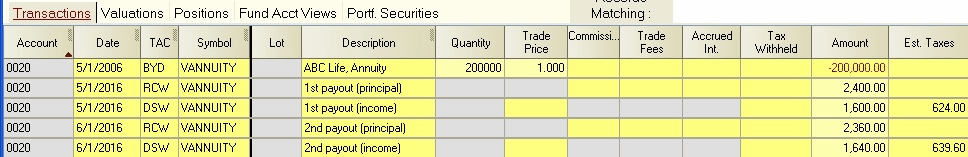

Variable Annuity - In the following example, a "variable" annuity was purchased in 2006 outside a tax-qualified plan. Only contributions need to be entered until payouts commence:

Once payouts commence, the payout is broken into non-taxable return of capital (RCW) and taxable income (DSW) components. If the annuity was purchased as a part of a qualified plan, then the entire payout is taxable. In this case, there will be no RCW transaction. This example assumes that the payouts are taken as a cash withdrawal, hence the RCW and DSW transaction codes. ROC and DST codes would be used if the annuity payments were retained in the account. The DSW or DST codes could be replaced with DVW or DV+ codes if the income is from qualified dividends.

Appreciation and reinvested income will be reflected in the portfolio position record for the annuity, when you enter the current total value of the annuity in the Value field.

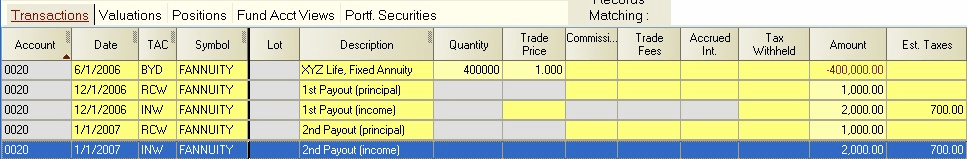

Fixed Annuity - A non-qualified "fixed" annuity is handled in a similar manner to the variable annuity, except that INW or IN+ is used for the income payments due to their being characterized as "interest":

Annuity Valuation - Since each annuity is a unique investment, there will be no single quoted market price to enter in the portfolio position records. However you can and should enter the total value of the annuity in the Value field of the position record.

The value of variable annuities will usually be available from the annuity statement issued by the annuity issuer. If a similar stated value is not available for a fixed annuity, its value should be determined by formula or table in the annuity contract specifying the annuity's buy-back price.

If an annuity has no buy-back provision, a table giving the cost to obtain an equivalent annuity can be used to estimate the current value of an annuity purchased previously. For example, suppose you currently are receiving payments of $1,000/month on an annuity purchased some time ago. To determine its current value, you can ask the issuer what it would cost at the present time for you to purchase an annuity with an equivalent current payout.