|

Abbreviated Portfolio |

|

|

|

|

Abbreviated Portfolio |

|

|

Abbreviated Portfolio

Many users will find that when they start using Captools/net they already have a considerable investment history in a form that is not easily imported or entered into Captools/net without a lot of work. Nevertheless, they would like for Captools/net to give them some measure of their prior investment performance. The solution to this is to enter an abbreviated form of your portfolio history.

The basic concept behind using an abbreviated portfolio history is to enter only the portfolio deposits and withdrawals and periodic total valuation from inception up until a recent date, and then from that point forward enter the full portfolio transaction and valuation detail.

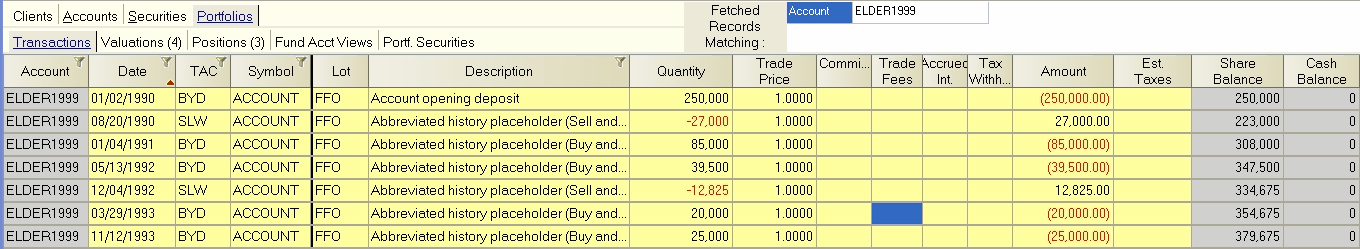

The abbreviated transaction history is entered by reviewing your old records and entering a BYD transaction for any deposit, and an SLW transaction for any withdrawal. A dummy security symbol is used (in this case "ACCOUNT"), and the share quantity is always the amount of the deposit or withdrawal and the trade price is always "1.00", as shown in the following example:

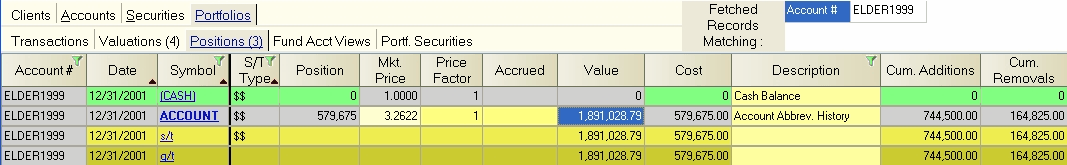

The abbreviated valuation history is created by entering valuation dates, and then valuing the single dummy portfolio asset in the position records at the total portfolio value on that date according to your records. The value is entered into the "Value" field, rather than entered into the "Mkt Price" field, e.g.:

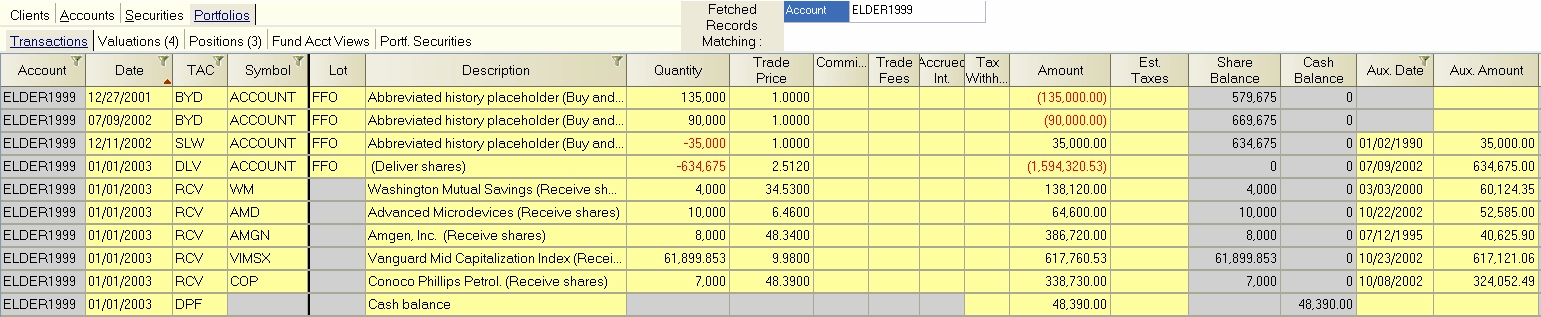

At the point in time where the portfolio is to be transitioned into a fully detailed portfolio, the dummy security is "Delivered" using a DLV transaction, and all of the actual securities in the portfolio are "Received" into the portfolio using a "RCV" transaction, e.g.:

Any cash balance contained in the portfolio is entered using a DPF transaction for a positive balance as in the above example, or a WDF for a negative balance. The relevant original purchase dates and cost basis for the RCV transactions can be entered into the "Aux Date" and "Aux Amount" fields as described in the topic Receive / Deliver.

At this point, all position records from the RCV date forward will show the full portfolio holding detail, and can be valued using the "Mkt Price" field as in a normal portfolio.